Education

Wesleyan Students Awarded National Medals in Scholastic Art and Writing Awards

Published

4 years agoon

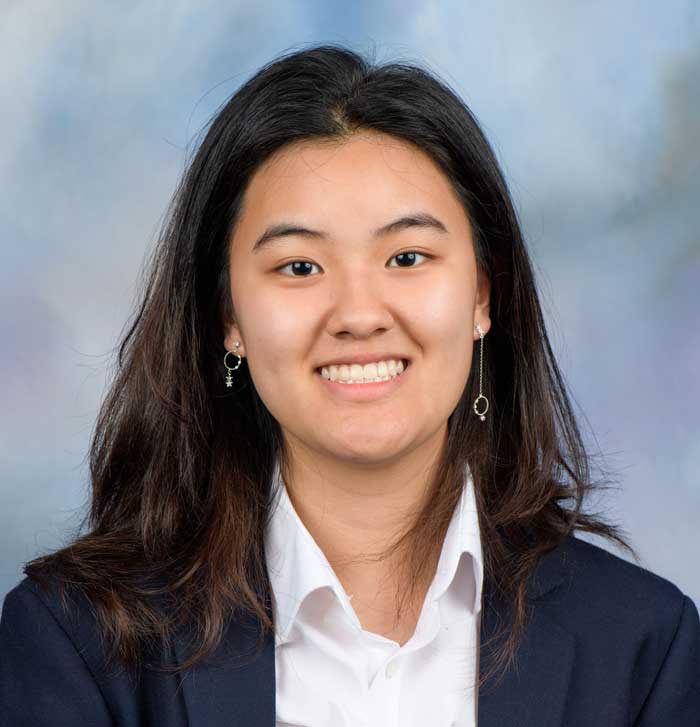

Ann Turner Kayla Kim

Wesleyan School is pleased to announce that sophomore Kayla Kim and senior Anna Turner have been awarded National Medals in the Scholastic Art & Writing Awards.

Kayla was awarded two medals, a Gold Medal for her drawing entitled “Imprisoned Truth” and a Silver Medal for her painting entitled “Worthless Lives.” Anna won a Silver Medal for her photograph entitled “Hidden Figure.” Both won regional gold keys and advanced to the National level. Gold Medals represent “the most outstanding works in the nation,” and Silver Medals are, “works demonstrating high honors on the national level,” according to the program’s website.

Each year, the Alliance for Young Artists & Writers partners with more than 100 visual arts and literary arts organizations across the country to bring the Scholastic Awards to local communities. Teens in grades 7–12 (ages 13 and up) apply in 29 categories of art and writing. This year, students submitted nearly 340,000 works of art and writing to the Scholastic Awards. National medalists make up only .8 % of entries.

Kayla and Anna will be recognized at the National Ceremony at Carnegie Hall in New York City.

The Scholastic Art & Writing Awards are presented by the Alliance for Young Artists & Writers. The Alliance is a 501(c)(3) nonprofit organization whose mission is to identify students with exceptional artistic and literary talent and present their remarkable work to the world through the Scholastic Art & Writing Awards. The Awards give students opportunities for recognition, exhibition, publication, and scholarships.

Related

Education

Spring Voting Will Determine Important Gwinnett School Board Elections

Published

2 days agoon

April 23, 2024

Five candidates vie for District 3 School Board seat this May 21st

If you decide to sit out the May primary and instead wait for the “big” election in November, you’ll be doing yourself and your community a disservice.

Although Congressional seats and the next leader of the free world will be decided, many local races will have a greater impact on day-to-day lives.

During a town hall meeting on March 24, Peachtree Corners City Councilman Eric Christ reminded residents that if they don’t vote on May 21, they’ll have no say in who represents them on the Gwinnett County Board of Education.

There are many candidates on the school board ballot. District 3, which includes Peachtree Corners, has five contenders for the seat vacated by long-time board member Dr. Mary Kay Murphy.

Christ pointed out that the nonpartisan race will be decided during the primary without endorsing a party or a candidate. County judges will also be elected.

Another unique aspect of this election is that there is no Republican candidate for county district attorney. So, those who show up on May 21 and request a Republican or independent ballot will have no say in who the next Gwinnett County district attorney will be.

“Some people think that if they say, ‘I’m nonpartisan,’ they’ll get to vote for either party,” said Christ. “It doesn’t work that way. They will only see judges and the school board on their ballot.”

So, in this particular race, if you have a strong opinion for or against someone in the county district attorney race, you will only be able to vote if you have a Democrat ballot.

For those looking to cast their votes on or before May 21, Southwest Gwinnett Magazine has sent a set of questions to all the school board candidates in District 3, asking their opinions about matters of education and school system governance.

Four of the five candidates replied.

Question #1: Why do you want to be a school board member?

Yanin Cortes: I am running for school board because I want a bright future for our communities and future generations. The reason why I moved to Peachtree Corners and decided to raise my family here 18 years ago was because of the school system and its reputation for providing a world-class education.

Gwinnett, for many years, has been a beacon of light for world-class education in the state of GA. Lately, however, we have seen our differences divide us. Our county is a mosaic with a diversity of appearances, opinions, and visions for the future.

I believe that our strength lies in our ability to unite for a common purpose. There is no greater purpose than the education and future of our children. I’m committed to becoming the bridge connecting the school board and our communities, amplifying our voice, fostering consensus and constructing a world-class school system.

As your representative on the school board my commitment will be to seek common ground not a political agenda. I will always prioritize our children and teachers over personal ambitions, concentrating on the essentials: student achievement, school safety, teacher support and community involvement.

Domonique Cooper: Having lived in Gwinnett County for the past twelve years, I’m passionate about giving back to our community by serving on the school board. My goal is to build a strong, unified team where the school board and community work together.

I’m committed to excellence in Gwinnett County Schools, and I believe my experience can be a valuable asset to our students, staff and stakeholders.

Steve Gasper: I’m running for school board to do what I can to help restore our faith and belief in our public schools and to continue the great work I’ve done so far at GCPS over the past nearly four years.

Shana V. White: As a third-generation teacher, I’m running because I believe it is time for an educator with K12 pedagogy experience and instructional knowledge to serve on the board to better meet the changing needs of K12 public schools and classrooms to support the creation of equitable, inclusive, safe and quality learning environments district-wide to meet the diverse needs of Gwinnett County students.

Question #2: Besides a desire to serve and help further the education of local children, what skills, experience, etc., do you bring to the table that makes you qualified?

Yanin Cortes: I am a mother, a former teacher in Gwinnett County Public Schools, and a small business owner.

As a teacher at Shiloh High School, I experienced and witnessed the same concerns and issues that our students, teachers and faculty still encounter every day.

As the owner of three restaurants here in Peachtree Corners and Norcross, I understand the level of hard work and dedication it takes to achieve success. I have learned through serving a diverse workforce and customer base that it is necessary to come together and find common ground to achieve success.

I believe that my experiences as a teacher and a business owner give me a unique, yet valuable skill set tailored to the job of a school board member.

Once elected, I will work to build consensus on the board to ensure that we, as a school board, are a productive and functional governing body that puts the interests of our students and staff first. I will put my breadth of experiences as a GCPS educator, local business owner, and an engaged and concerned parent into every decision I make on the board.

Domonique Cooper: From my time in the Federal Government, I possess expertise in data management, policy planning and fiscal development – skills crucial for navigating school board budgets and ensuring efficient operations.

As a Gwinnett County Public Schools substitute teacher, I honed my classroom management skills, effectively interpreting lesson plans and crafting reports to benefit student progress. This experience gives me invaluable insight into the daily lives of our teachers and students.

My entrepreneurial experience fostered strong communication, salesmanship, and strategic thinking. I can leverage these skills to build relationships with parents, advocate for our schools, and find creative solutions to educational challenges.

Additionally, as an educational strategist, I am a champion for parental involvement, policy improvement, and a more positive educational environment. I am skilled at evaluating achievement gaps and developing strategies to ensure all students thrive.

Steve Gasper: I am a former elementary school teacher who grew up in an education-centered home, as my mother is a retired, 30-year first-grade teacher. I am a graduate of the University of Southern California with a bachelor’s degree in business management and organization.

My wife and I are owners-operators of a vacation rental business and I’ve been a corporate sales and management leader for over 23 years.

I’ve also been intimately involved in GCPS over the past nearly four years, speaking at numerous BOE meetings, meeting with the previous as well as the current Superintendent, meeting and collaborating with senior district leadership, working with several current BOE members to build working relationships, and participating in district committees such as the Instructional Resources Review Committee (IRRC), the Discipline Task Force and the Superintendents Transition Planning Team.

I’ve also collaborated with several State Elected Officials to discuss ways we can create positive education policies for not only Gwinnett County but our entire state.

I’ve been the voice for teachers, parents and our community during this time. I’ve had my “thumb to the pulse” of our community, gaining insight on topics that are most important in real-time.

Shana V. White: I have been a K12 public and private school educator in Georgia for over 15 years.

I have been a varsity basketball coach at The Paideia School, Pace Academy, Peachtree Ridge HS,and Wesleyan School.

At Peachtree Ridge HS and Pace Academy, I was the varsity head coach for a total of 5 years combined. I have been both a classroom teacher and LSTC (local school technology coordinator) in Gwinnett County Public Schools for over 10 years, working at Creekland MS, Peachtree Ridge HS, Summerour MS, and Sweetwater MS.

I currently work with a national philanthropic organization (Kapor Foundation) that supports equitable computer science implementation and resources for K12 public school districts.

Additionally, as a part of my role, I currently directly support Muscogee County Schools (GA), Early County Schools (GA) and Oakland Unified School District (CA) with their computer science implementation as well as lead and facilitate professional development for teachers and school district leaders across the nation in K12 computer science equity, culturally responsible and sustaining computer science, ethical artificial intelligence and computational thinking.

Question #3: Lately, there has been a lot of press about school boards being pressed to eliminate or massage history lessons that may make some students and/or families uncomfortable. What is your reaction to this? And what would you do in similar situations?

Yanin Cortes: I believe that history is a vital component of a well-rounded, world-class education. It is necessary for us to learn from our mistakes and to understand how we got here to prepare our students for the world stage.

That said, the school board should be able to reasonably accommodate those who might find certain materials distressing. We must always take into account maturity and grade level when it comes to all learning materials.

Domonique Cooper: It’s concerning when efforts are made to remove or downplay uncomfortable aspects of history. History, by its very nature, isn’t always rosy.

Sanitizing the past prevents us from learning from mistakes and hinders a complete understanding of the present. Schools have a responsibility to teach history accurately and comprehensively, even the difficult parts.

What I would do:

- Focus on historical context: Uncomfortable events should be presented within the context of the time period. Explain the prevailing social norms, biases, and limitations in understanding of the past. This allows for a more nuanced discussion.

- Multiple perspectives: Show history from the viewpoints of different groups involved. This fosters empathy and critical thinking skills.

- Open discussions: Create safe spaces for students to discuss sensitive topics and grapple with complex issues. Encourage respectful dialogue and guide students towards evidence-based conclusions.

- Acknowledge the discomfort: It’s okay for students to feel uncomfortable with certain historical events. Use that discomfort as a springboard for deeper learning and critical reflection.

- Transparency with parents: School boards should involve parents in discussions about curriculum but emphasize the importance of a complete historical picture. Offer resources and open communication channels for parents who may have concerns.

By teaching a comprehensive and inclusive version of history, we can empower future generations to be informed, engaged citizens who can work towards a more just and equitable society.

Steve Gasper:My feeling is that history is our history and should be told exactly how it was. If we eliminate or massage history lessons, how can we learn and possibly improve upon our past to make us better people in society? I would support teaching history lessons as they are written and not altered.

Shana V. White: In an increasingly polarized climate, a variety of emotions come to the surface for individuals or groups. Any time discussions or topics are polarizing in nature, our first response should be always to listen to understand.

Students and families are stakeholders in our public school system and have the right to be heard at school board meetings. As a teacher, I believed in teaching students the grade-appropriate truth as it relates to the history and current events of the United States as well as the world in a facts-based manner.

As educators our job is to demonstrate respect for all students as full human beings by providing them accurate information from a historic or current context and then give them the time and space to ponder, discuss and interrogate information.

As Dr. Martin Luther King said in an article in 1947, “education must enable one to sift and weigh evidence, to discern the true from the false, the real from the unreal, and the facts from fiction.”

Question #4: In Gwinnett County, students come from diverse socio-economic, racial, and cultural backgrounds. What strategies would you implement to ensure all students have equitable access to educational resources and opportunities?

Yanin Cortes: We need to ensure that we provide all students with a pathway to success and to do this, we must double down on what works.

This starts with early learning and school readiness. The Play 2 Learn initiative, which helps prepare infants through 5-year-olds for kindergarten and beyond, has been a great resource for families in our district.

The results of this program have been a massive success, and I believe that its expansion will benefit all students in our county.

Furthermore, Gwinnett County has received tremendous praise for its successful schools and programs, specifically in areas of STEM and other technical education areas. A safe learning environment goes hand in hand with making quality education possible.

Schools that create a safe learning environment have been more successful in our district. We must ensure the presence of at least two safety resource officers at all times in all of our schools. Further investment in these successful programs and initiatives is key to ensuring that we provide a pathway to success for all students.

Domonique Cooper: Here are some strategies I would use to ensure equitable access to educational resources and opportunities for all students in Gwinnett County’s diverse student body.

Addressing resource disparities:

- Needs-based funding: Allocate resources to schools based on student needs, ensuring schools with higher populations of low-income students have the necessary funding for qualified teachers, updated materials, and smaller class sizes.

- Technology equity: Provide all students with access to high-speed internet and up-to-date devices at school and home. Offer training and technical support to bridge the digital divide.

- Multilingual resources: Ensure textbooks, assignments, and support materials are available in multiple languages to remove language barriers for non-native English speakers.

Supporting diverse learners:

- Culturally responsive teaching: Train teachers in culturally responsive pedagogy to create inclusive classrooms that value diverse perspectives and learning styles.

- Early childhood education: Invest in high-quality early childhood education programs, particularly in underserved communities, to ensure all students enter kindergarten with a strong foundation.

- Targeted academic support: Provide targeted interventions and support programs for students who are struggling academically, including programs for gifted and talented students, ESL learners, and students with disabilities.

Expanding opportunities:

- Advanced Placement (AP) for all: Expand access to AP courses and provide targeted support to help all students, especially those from traditionally underserved backgrounds, qualify and succeed in these rigorous programs.

- Career and technical education (CTE): Ensure all schools offer a variety of CTE programs that expose students to different career paths and provide valuable job skills.

Fostering a culture of equity:

- Data analysis and transparency: Regularly collect and analyze data to identify and address equity gaps in student achievement and access to resources.

- Community partnerships: Collaborate with community organizations to provide wraparound services such as after-school programs, healthcare access, and mental health support.

- Student and parent voice: Actively solicit feedback from students and parents from diverse backgrounds to understand their needs and concerns, and ensure they have a voice in shaping educational decisions.

By implementing these strategies, Gwinnett County can create a more equitable learning environment where all students, regardless of background, have the opportunity to succeed.

Steve Gasper: The diversity of Gwinnett County is what makes this a great county to work and live in, and that should be celebrated. No one should be singled out, excluded or denied access to any educational resources and opportunities. These are our future leaders and need all that we can offer them to be prepared as such.

Shana V. White: Improving educational equity, which meets the needs of diverse racial, cultural, socio-economic and ethnic backgrounds of all, first requires all stakeholders to be on the same page.

We must have hard conversations with students, parents/caregivers, teachers and school/district administration to truly set collective strategies and goals, as educational equity work will look different at each school if it is done correctly.

Broadly, equity in schools should include providing opportunities, access and resources that help all students with diverse needs obtain success. One overall strategy to improve equity in schools involves first assessing the opportunity gaps that exist that are hindering success for all students.

One strategy I used when I was a teacher was making an intentional effort to understand the variety of intersecting identities of our students and how to make the learning environment one where all students and their identities belong.

Additionally, explicitly listening to the voices of students as well as their parents/caretakers and asking them what they need to be successful is an often-overlooked strategy for improving equitable student learning.

Finally, providing teachers with quality training and resources to build equitable learning environments in their classrooms.

Some of those tools include Universal Design for Learning and translanguaging to better meet the needs of students with disabilities and emerging English language learners.

Question #5: Gwinnett County, like almost every other school system, has struggled in the past decade or so to retain personnel — teachers, school bus drivers, etc. Do you have thoughts on how to attract and retain qualified candidates?

Yanin Cortes: We, as a school board, need to project a stable, forward-thinking and forward-planning culture within our school system.

We must utilize the existing support systems in our district to provide support for educators and faculty who are the lifeblood of our district.

As a former teacher, I understand that teachers and staff need support and transparency from administrators and district leaders to feel that they can effectively teach and do their jobs. Teachers need planning time, they need a heads-up when we, as a board, decide to implement a shift in policy.

I know that teachers do not want to bounce from school to school and district to district. Teachers desire a stable and safe teaching environment.

As a school board, we must be there not to micromanage them but to support them. On the school board, I will make it a priority to show our teachers and staff that we are there to support them, not just through words but through our actions as a school board.

Attracting and retaining talented staff is a multidimensional approach. There is a variation of strategies for both aspects.

Domonique Cooper: Attracting personnel, teachers, school bus drivers, etc., is a two-pronged approach.

- Showcase Gwinnett County Public Schools (GCPS) brand: Develop a strong reputation that highlights GCPS company culture, values and unique perks.

- Offer competitive compensation and benefits: Salary and benefits are a major draw. Research what’s competitive in a similar sized district to attract top talent.

- Retaining Qualified Candidates requires a variety of solutions to support stable staffing.

- Prioritize company culture: Create a positive work environment that fosters collaboration, growth and work-life balance.

- Invest in professional development: Offer training programs, mentorship opportunities, and support for employees to develop their skills and advance their careers.

- Recognize and appreciate employees: Make them feel valued for their contributions. Public recognition, rewards programs and promotion from within go a long way.

- Monitor employee engagement: Stay on top of employee sentiment. Conduct surveys and have open communication channels to address concerns and foster a sense of belonging.

By focusing on these aspects, Gwinnett County Public Schools will be able to attract and retain qualified employees and high-caliber candidates by keeping them happy and productive for the foreseeable future.

Steve Gasper: Our district personnel (teachers, administrators, counselors, custodians, cafeteria workers bus drivers, etc.) are the lifeblood of our school system.

Without them, we would cease to exist.

It should be our main focus to make sure they feel happy and fulfilled in their jobs. Over the past several years, GCPS has lost many great administrators, teachers, and those who support them.

We need to provide a safe, welcoming, and supportive environment for them by creating effective staff retention programs (competitive pay, benefits, growth opportunities and support services).

We must work to remove any roadblocks that prevent them from being successful. This is one of the areas that is extremely important to me and will be a main focus for me when elected.

Shana V. White:Teaching as a profession nationally is undervalued and under respected. One of the things I would like to see improved as a former classroom teacher in Gwinnett is the quality of school site-based leadership.

School site leadership must clearly understand the school’s culture and climate is largely based on how teacher, staff and students are treated daily in the building daily. All school district leadership must better equip school site leaders with the training, resources and decision-making ability to make their schools a place where all teachers can thrive.

Making intentional efforts by school administrators to support teachers with duty-free planning, increased agency in their classroom, supporting all diverse learners’ needs in the building, making collective decisions on school policy and implementation, collaborative lesson/unit planning time, as well as uplifting teachers on a regular basis, are all items that would really go a long way in retaining teachers and making them feel valued.

As it relates to other school personnel, similar ideals of making them feel valued and an important part of the success of a school system is key. One way to value other educational personnel (bus drivers, office staff custodians, etc.) includes having leadership in place with clear and consistent expectations that are communicated.

Additionally, humanizing the work environment as much as possible and having personnel leadership open to feedback and ideas from staff go a long way to validating employees.

Related

Education

The End of an Era: Dr. Mary Kay Murphy’s Final Term on The Gwinnett County Board of Education

Published

3 weeks agoon

April 4, 2024

December 31, 2024, will mark the conclusion of the distinguished, seven-term service of Dr. Mary Kay Murphy on the Gwinnett County Board of Education — District III. Until then, Dr. Murphy remains actively engaged and dedicated to the important work of Georgia’s largest school district.

The pivotal role the community plays in identifying thoughtful candidates of ethical conduct could not be better highlighted than by Dr. Murphy’s 28 years on the board.

Reflecting on the impending end of her tenure and her involvement in setting the goals of the school system, which she has relished being a part of Dr. Murphy stated, “I’m sorry it’s coming to an end. There’s an attachment that comes with these experiences. I can’t believe how much I’ve enjoyed it and will miss it.”

An illustrious career

The many important roles Dr. Murphy will cherish include chairing the Gwinnett Board and the Georgia School Board Association, serving on the Seventh District Advisory Committee for local school board governance and the Governor’s Advisory Committee on school boards.

Her multi-faceted career provided valuable insights into public school education and state-level funding, benefiting both rural and urban Georgia. A rather extraordinary woman herself, Dr. Murphy humbly treasures memories of having worked with many remarkable individuals.

Dr. Murphy’s journey began amid fears surrounding the system’s decision to embrace Outcomes Based Education (OBE). OBE is a student-centered learning model which focuses on what students know without relying on rote memorization. As the community geared-up for the 1996 elections, worried citizens rallied to prevent what they felt would be a lowering of academic standards in favor of social promotion, where students might advance to the next grade without meeting proficiency levels.

It was a pressing issue casting a shadow of concern over the future of public education when Dr. Murphy began her first term in January of 1997. She commended the community’s united front, emphasizing their collective concern for the well-being and educational outcomes of all children, not just their own.

A perfect fit

This grassroots movement spurred the need for change and the election of new board members including Dr. Murphy, who shared the community’s vision for a robust and equitable education system. Recalling her entry into the role, Dr. Murphy revealed that initially her husband, Michael Murphy, was the intended candidate due to his extensive legal background.

However, he declined because he wanted to focus on his practice, recommending they consider “someone he knew at home” who’d be perfect. Dr. Murphy stepped into the role, supported by her husband who served as her campaign manager throughout her seven terms. She joked that they had only themselves to blame for nearly three decades of many cold or late dinners.

Dr. Murphy emphasized the importance of honest leadership, with a deep-seated commitment to prioritizing public education. During her initial victory she secured 63% of the vote, underscoring the community’s trust in her capabilities.

Throughout her tenure, community feedback played a significant role in shaping her decision to seek reelection. Recognizing the value of introducing a fresh perspective to the board is what guided her choice not to seek an eighth term.

Professional highlights

Dr. Murphy values the magnitude of each board member’s role and broader impact. Every vote affects over a million people — residents, students and neighbors — as it applies to the entire county’s population, not just to their respective districts. The responsibility of shaping educational policies and initiatives is one she has always taken very seriously.

According to Dr. Murphy, Gwinnett County found a beacon of hope in Mr. J. Alvin Wilbanks, when the former president of Gwinnett Technical College assumed the role of superintendent. Under 25 years of his leadership, the school system witnessed significant innovations aimed at addressing students’ academic, social, physical and emotional needs.

One of the most notable achievements during Mr. Wilbanks’ tenure was the recognition of Gwinnett County Public Schools (GCPS) by the Broad Foundation as the Best Urban Public School System in the nation in 2010 and 2014. This acknowledgment, accompanied by $1,500,000 in scholarship awards, highlighted the strides made in closing the achievement gap and ensuring educational excellence for all learners.

Academic knowledge and skills

To combat fears of social promotion stemming from OBE, GCPS pioneered the specialized Academic Knowledge and Skills (AKS) curriculum. This approach led to the school system developing its own standards of excellence which many deem to be higher than those set forth by the State of Georgia.

GCPS teachers are required to teach their academic programs incorporating the AKS component of their discipline. Dr. Murphy is proud of the access teachers have to professional development, allowing them to make the AKS curriculum their own.

International Baccalaureate

Dr. Murphy highlighted various initiatives aimed at meeting diverse student needs. Some of the work of which she is most proud includes being present at the onset of the International Baccalaureate (IB) programs offered at Norcross and Shiloh High Schools, Pinckneyville and Summerour Middle Schools, and Peachtree Elementary School.

The IB programs, with globally recognized standards, are designed to be academically rigorous while promoting intercultural understanding, inspiring young minds to work towards a better world. Never has a cross-cultural approach to creating a just and peaceful world been more important than now.

“It took the vote of five and the leadership of the superintendent to bring that to fruition. It also took insight from the community that thought this was a good use of taxpayers’ money,” Dr. Murphy explained.

Dual-Language Immersion

The Dual-Language Immersion (DLI) programs coincide with research — the time to learn a second language is during the formative years of childhood. GCPS’ 50/50 Model means at least 50% of the day is spent learning in the target language.

Trip Elementary School (ES) offers French. Baldwin ES offers Spanish. Students study Korean at Parsons ES. The New Life Academy of Excellence Charter School provides instruction in Mandarin Chinese. Every year it is a leader in student performance.

DLI has been a great investment, in Dr. Murphy’s view. “It’s an amazing thing to see little folks taking on the responsibility and being alert to the benefits of learning a second language,” she shared.

Philanthropy is key in District III

Dr. Murphy lauded the community’s philanthropic efforts, citing the Norcross High School Foundation for Excellence as an exemplary model of parent-led initiatives. Through events like annual galas, the foundation has raised funds to support teacher grants, after-school programs and infrastructure improvements, enriching the educational experience of scholars for over 20 years.

As Dr. Murphy reminisced about her own experience as a board member, she underscored the profound impact of community engagement and collaboration in shaping the trajectory of public education in Gwinnett County. Through shared vision, advocacy and tireless dedication, stakeholders have transformed challenges into opportunities, ensuring that every child receives a quality education and the support needed to thrive in an ever-changing world.

Many parents participate in the good works of local schools by donating their time and talents even after their kids have gone to college. “It’s been an amazing thing to see their spirit of philanthropy continue,” Dr. Murphy remarked.

“I think District III is in extremely good shape. We’ve got tremendous principals, community members who truly care about these schools and a variety of schools to meet student needs,” she observed.

SPLOST

According to Dr. Murphy, the Special Purpose Local Option Sales Tax (SPLOST) has greatly enhanced school system facilities. The community’s unwavering support for SPLOST referendums has enabled rapid growth and expansion through the construction of 76 new schools since 1997. Norcross High School, funded in part by SPLOST revenues, stands as a testament to the community’s commitment to investing in public education infrastructure.

Under the leadership of the Superintendent, the board works to balance the yearly budget, thereby steering the course of property taxes and allocations. Dr. Murphy revealed this year’s budget to be approximately $2.8 billion dollars and was happy to announce the 19.2 school millage rate would remain the same.

“Even though some of our housing properties have increased in value, our millage rate will not increase. We’ve been able to keep it steady for almost seven years,” Dr. Murphy shared.

The Great Recession

During the economic downfall of 2008, Governor Nathan Deal’s Austerity Cuts included $100,000,000 out of the state budget for public education. Dr. Murphy is proud that GCPS, through the leadership of the superintendent and his staff, made certain that teachers were able to keep 190-day contracts.

“This did not happen in many school systems, where the funding of the property tax would not allow for it. We saw teachers’ salaries cut to 140 days,” Dr. Murphy said.

Extra large

It’s difficult to fathom the logistics of the largest school district in Georgia — the 11th largest in the U.S. GCPS includes 144 schools. When Dr. Murphy first started there were nine schools in District III. Today, her district comprises 30 schools.

Calling attention to the remarkable high schools, some of the largest in the country including Norcross, Duluth, Peachtree Ridge, North Gwinnett and Paul Duke STEM, Dr. Murphy celebrates the options available to students.

“The Norcross cluster was the first to provide two high schools for students so that they and their parents could have an opportunity for school choice. That took place approximately five years ago, when Paul Duke opened,” Dr. Murphy beamed.

Paul Duke

Paul Duke STEM High School on Peachtree Industrial Boulevard was named after the Georgia Tech graduate who founded Peachtree Corners. Dr. Murphy recalled the day of dedication with an auditorium bursting at the seams with Duke’s Georgia Tech colleagues and people who built Peachtree Corners.

Opening two high schools was the solution as Norcross could no longer increase its enrollment to accommodate the rampant growth in District III. Norcross High School maintained its important niche with the IB program from kindergarten through senior year.

Paul Duke became a Science, Technology, Engineering and Mathematics (STEM) school — in keeping with the purpose behind the founding of Peachtree Corners — to provide technology jobs that would keep Georgia Tech graduates and engineers from moving out of state.

The GIVE Center West

Just down the street from Paul Duke is an alternative school, The GIVE Center West or Gwinnett Intervention Education serving grades 6 through 12. It aims to prepare students for graduation and transition back to their home school if they wish, with improved academic and behavioral skills.

Academics and the arts

Since 2014, The North Metro Academy of Performing Arts has brought a new dimension for elementary school families craving something beyond the standard curriculum by integrating it with the performing arts. Instruction at North Metro fosters collaboration, imagination and confidence.

They can’t all be golden

One regret Dr. Murphy expressed was the board’s unfortunate 2023 decision to change the GCPS discipline policy. She readily admits that she initially went along with it believing teachers and principals would receive the professional development needed to make Restorative Justice work with students.

Restorative Justice is defined by Dr. Murphy as a commitment to the relaxation of the initiatives that would punish a student for behavior. “The relaxation was felt from the top of the organization to the bottom. We had unbelievable student unrest, students fighting one another, bringing weapons to school, losing their mooring, basically,” Dr. Murphy recounted.

The aim of Restorative Justice is to have students understand their inappropriate behavior and be self-motivated to change it. A restructuring of student relationships with teachers and counselors is a component of the lighter discipline model.

As a former teacher, I could not refrain from wondering aloud, “How did this happen?” I learned it was the election promise of some board members.

“Elections have consequences,” Dr. Murphy warned. Not far into the process, Dr. Murphy rescinded her vote to support the change in discipline and insisted on a mid-course correction.

New leadership

Crediting Superintendent Dr. Calvin Watts for finding a pathway, Dr. Murphy believes things are moving in the right direction now. “It was a hard lesson and I’m confident our board has learned from it,” she stated.

After Mr. Wilbanks was Superintendent for 25 years, Dr. Watts has risen to meet the challenge of managing both changes and stability.

Yet she remains positive and hopeful about what the coming months will bring.

“There’s an awareness and we have every benefit of some awfully good minds. If there’s one thing we have, it’s a lot of brain power throughout 183,000 students and 25,000 teachers and principals,” Dr. Murphy remarked.

Funding

A generous allotment of federal money, approximately $1,000,000,000, was contributed to the school system by the federal government with the stipulation that it must be spent by September 2024. The money has been instrumental in easing students back into school after extended absences due to COVID.

“It has helped us employ counselors in larger numbers than we’ve had before, social workers, people who can help us face the challenges from COVID. With budget season ahead, the board is now challenged with providing those services without federal funding,” Dr. Murphy said.

Continuous improvement

While school board members are evaluated at the ballot box, as Dr. Murphy pointed out, principals and teachers are evaluated by parents and their students. Dr. Murphy feels the online evaluations provide meaningful feedback.

Weekend warrior

Aside from her day job, Dr. Murphy spent three years traveling in the name of institutional advancement. Fulfilling her role as adjunct professor was important to her. Traveling to Nashville on weekends, Dr. Murphy taught English at Vanderbilt University’s Peabody College. For three additional years she did the same at LaGrange College near Columbus, Ga.

At Vanderbilt Dr. Murphy had about 15 students from all over the country keeping the same weekend schedule. Directing the programs at both colleges, she was glad to follow her students over the course of their three-year programs.

After her final term

After wrapping-up her school board endeavors on December 31, 2024, you can find Dr. Murphy enriching the community from the board of The Georgia Humanities Council.

Championing the humanities, which have added value to the lives of so many besides her own family, Dr. Murphy shared, “The humanities have a historic role to play in creating critical thinkers engaged in community life. I’m looking forward to being a part of this organization and meeting people from all over the state. I’m thinking how appreciative I am of the humanities teachers and professors in GCPS and in the state.”

With her husband, Dr. Murphy looks forward to creating memories and spending quality time with their 11-year-old twin grandchildren — one boy and one girl. They’ll be cheering for them on the baseball field and basketball court.

In the same breath that she expressed the desire not to get too regimented, Dr. Murphy confided, “There’s nothing like a good project to work on.”

A lasting impact

Despite her decision to step down, Dr. Murphy remains steadfast in her dedication to education, acknowledging that the work is far from finished. Looking back on her impactful career, she expressed gratitude for the opportunity to serve her community through the advancement of public education.

Although she’s been recognized in many ways for her steadfast service, two awards hold special meaning for her: the Paul Duke Lifetime Achievement in Education award and the Boy Scout award.

Dr. Murphy concluded, “I’ll always have a great place in my heart for the work on the Gwinnett County Board of Education. It’s given me so much joy and a sense of continuity. There’s always something to learn and it’s important to remember to bring others along.” Preparing to pass the baton to a new generation of leaders, Dr. Murphy’s legacy of integrity, dedication and passion for education will undoubtedly leave a lasting imprint on the Gwinnett County School System.

Find more Peachtree corners education stories here.

Related

Education

Norcross High School Foundation for Excellence Celebrates Trio of Educators

Published

3 weeks agoon

April 4, 2024

The Norcross High School (NHS) Foundation for Excellence shows what a community can achieve when it rallies around educational success. The Foundation was established in 2001 as a 501(c)(3) corporation. It has been key in filling the gap between state and county funding, ensuring that every Norcross High School student has access to a great education.

“The NHS Foundation Board, in its efforts to support its mission, meets monthly with school administration officials to better understand their vision for the school, which consists of three main pillars: student achievement, staff retention, and community support,” commented Erin Griffin, co-president of the NHS Foundation.

Through its fundraising efforts, the NHS Foundation aims to create a nurturing environment where students and staff can thrive together.

The NHS Foundation’s fundraising supports this vision. It does so by raising and giving funds to the following categories:

- Teacher Grants for large and small classroom or department resources,

- Staff Recognition,

- Instructional Funds for miscellaneous supplies,

- Capital Improvements,

- Endowment and

- Principal’s Discretionary Fund.

Taking great education to the next level

The Foundation’s core values focus on making great education even better. The mission is clear: build community support and raise funds to foster excellence in academics, arts and athletics. It’s all underpinned by a belief in the potential success of every student.

A highlight of the Foundation’s annual efforts is its gala, which started in 2005. This event not only raises funds but also celebrates the contributions of individuals who have positively impacted the NHS community.

In 2023, the gala had a “teacher wish brick” initiative. It let attendees support specific teacher needs. It ended up. raising over $25,000, showing the community’s investment in its school.

“In 2023, supporters purchased more than $25,000 in bricks, ranging from $50 in JROTC supplies to $1,000 in sheet music and instrument mouthpieces for the band and orchestra,” said Griffin.

The annual gala was started to raise funds for Norcross High School and create community awareness.

The first gala was hosted at the home of Jan and Aaron Lupuloff. What began as a gathering at their home expanded into an event that now attracts over 500 guests.

“Each year, the gala is a celebration of individuals who significantly contribute to the advancement of arts, athletics and academics at Norcross High School and an opportunity for families and community members to support the work of the NHS Foundation,” Griffin added.

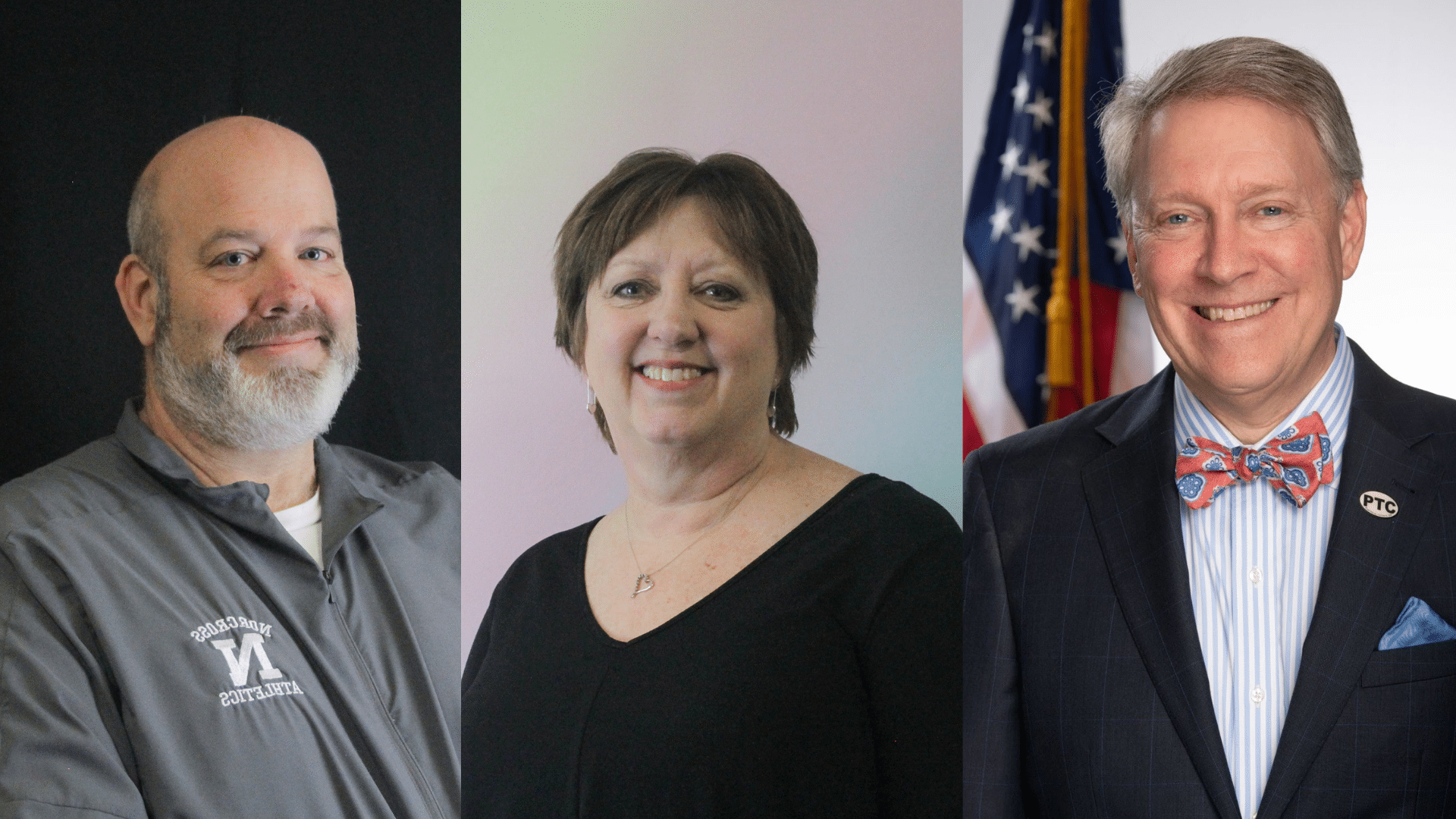

Meet the 2024 honorees

Weare Gratwick has a wealth of experience from over 35 years in the banking industry. He has significantly influenced the financial and communal landscape of Peachtree Corners. His tenure as the Gwinnett Market President for Tandem Bank and role as Vice Mayor for the Peachtree Corners City Council demonstrate his commitment to local governance and economic development.

Gratwick’s involvement with the NHS Foundation Board as Treasurer showcases his dedication to educational excellence.

But his connection goes even deeper. His daughters are NHS alumni and he has been active in the community since 1995. Gratwick also has leadership roles in many civic and community organizations.

“I am honored to be recognized by the Norcross High School Foundation who continues to do important work ensuring NHS remains a great school. Quality schools are at the heart of a vibrant community and NHS continues to be essential to the success of both the Peachtree Corners and Norcross communities,” Gratwick expressed.

Kirk Barton has been a pillar in the NHS community since 1999. First serving as a health and PE teacher and coach, his transition to Activities and Athletic Director was significant.

Under his direction, NHS secured 12 State Championships in multiple sports. Barton’s administrative role grew his influence. He now supports not only athletics but also the fine arts, enriching the school’s culture and extracurricular activities.

He was recognized four times as the region athletic director of the year. He was also named twice as the classification athletic director of the year for Georgia. These honors mirror his skill in sports administration and community leadership.

Barton is married with grandchildren. His personal life adds a layer of community connection and shows his deep commitment to the area he serves.

Lynne Zickel Kliesrath’s journey from a dedicated volunteer to an essential administrative member at NHS is a story of unwavering commitment to educational support.

She started as a volunteer when her eldest daughter began kindergarten. Kliesrath was very involved in the Collins Hill cluster’s PTA and school councils. This set the stage for her deep engagement with the educational system.

Her move to a GCPS employee and later roles in NHS, especially as the athletic assistant, show her varied contributions and dedication.

She was also the recipient of the Dave Hunter Community Service Award and the title of “Staff Member of the Month.”

“Thank you to the Norcross High School Foundation for this great honor and for my recognition into the Hall of Fame. And I want to say how much we appreciate everything the foundation does for our students, our staff, and the Norcross High School community. Thank you for making me a part of the Norcross High School Foundation family!” exclaimed Kliesrath.

What’s next for the NHS Foundation?

These three individuals have varied yet connected paths that have contributed to Norcross High School and its community. Their lives and careers are emblematic of the Foundation’s ethos, valuing community engagement, educational support and excellence.

As the Foundation looks to the future, it continues to build on its legacy of excellence, ensuring that Norcross High School remains a beacon of educational success. The dedication of individuals like Gratwick, Barton and Kliesrath, coupled with the community’s ongoing support, ensures that the Foundation will continue to play a vital role in shaping the leaders of tomorrow. The next NHS Foundation Gala will be held on April 19 at the Crowne Plaza Atlanta NE in Norcross.

Find more Peachtree corners education stories here.

Related

Read the Digital Edition

Subscribe

Keep Up With Peachtree Corners News

Join our mailing list to receive the latest news and updates from our team.

You have Successfully Subscribed!

Exploring Israeli Innovation in the Smart City Sector with Einav Gabbay [Podcast]

North American Properties Secures 3 New Brands for The Forum

Georgia United Methodist Foundation Announces Changes to Finance Team

North American Properties Revitalizes Avenue East Cobb

BRACK: Peachtree Corners to lose Peterbrooke Chocolatier

Spring Voting Will Determine Important Gwinnett School Board Elections

Local Non-profit Boy With a Ball Announces Dates for Upcoming Conference

Local Non-profit Boy With a Ball Announces Dates for Upcoming Conference

Spring Voting Will Determine Important Gwinnett School Board Elections

BRACK: Peachtree Corners to lose Peterbrooke Chocolatier

Georgia United Methodist Foundation Announces Changes to Finance Team

North American Properties Revitalizes Avenue East Cobb

Exploring Israeli Innovation in the Smart City Sector with Einav Gabbay [Podcast]

North American Properties Secures 3 New Brands for The Forum

April/May Events Going on at Gwinnett County Parks

Light up the Corners [Video]

Capitalist Sage: Business Leadership in Your Community [Podcast]

Cliff Bramble: A Culinary Adventure through Italy

Top 10 Brunch Places in Gwinnett County

A Hunger for Hospitality

THE CORNERS EPISODE 3 – BLAXICAN PART 1

Top 10 Indoor Things To Do This Winter

The ED Hour: What it takes to Remove Barriers from Education

Peachtree Corners Life

Topics and Categories

Trending

-

Podcast1 week ago

Exploring Israeli Innovation in the Smart City Sector with Einav Gabbay [Podcast]

-

Faith1 week ago

Georgia United Methodist Foundation Announces Changes to Finance Team

-

Business1 week ago

North American Properties Revitalizes Avenue East Cobb

-

Business6 days ago

BRACK: Peachtree Corners to lose Peterbrooke Chocolatier