Business

Capitalist Sage: How Barter Can Help Small Business During COVID19- Pandemic [Podcast]

Published

4 years agoon

An age-old tradition of bartering between businesses is still alive and well thanks to the Southern Barter Club and founder Laurie Sossa, our guest on today’s episode of the Capitalist Sage. Learn how your business can barter and the benefits of working with SBC. Join Rico Figliolini and Karl Barham as they chat with Laurie about how SBC works, the benefits of barter, and exactly how to make bartering a part of your business.

Resources:

SBC Website: SouthernBarterClub.com

Global Website: SBCGlobalBarter.com

Phone Number: 678-547-0900

“We are here for the community. So, you know this is a time, more than ever, that we have to really just be a resource to one another… So definitely, what I’m hoping that everybody gets out of this more than anything is even if they don’t work with Southern Barter club, start slowly even with just leveraging what you have, your time, your resources, your assets, and don’t be afraid to approach another business owner you want to do business with. That’s your neighbor or colleague or someone you’ve always worked with… So if anything, we hope there’s awareness to bartering and trading.”

Laurie Sossa

Show Notes:

[00:00:30] – Intro

[00:03:17] – Laurie’s History with Barter

[00:05:42] – How Barter Works

[00:07:09] – Typical Trades

[00:14:29] – Businesses That Could Benefit

[00:18:28] – Pricing Concerns

[00:26:41] – Why Doesn’t Everyone Barter?

[00:29:23] – Business Expenses

[00:32:13] – Closing

Podcast Transcript

Karl: [00:00:30] Welcome to the Capitalist Sage Podcast. We’re here to bring you advice and tips from seasoned pros and experts to help you improve your business. I’m Karl Barham with Transworld Business Advisors, and my co host is Rico Figliolini with Mighty Rockets Digital Marketing and the publisher of the Peachtree Corners Magazine. Hey Rico, how are you doing today?

Rico: [00:00:47] It’s a beautiful day, Karl. Glad to be out here.

Karl: [00:00:50] Absolutely. Things are opening up. And little by little, I see activity happening throughout. So, we’re here doing this virtually, as we continue with the COVID-19 pandemic, but today… Innovative ways for, that folks are handling business during the pandemic. Let’s start off with our sponsors Rico.

Rico: [00:01:15] Sure. Well, let me introduce the sponsor, our lead sponsor in the family of podcasts, is Hargray Fiber. They’re a very large Southeastern based fiber cable company that provides solutions both to small businesses and large enterprise businesses. When it comes to internet connection and working online, teleworking and providing the bandwidth as well as fiber to these companies to be able to do what needs to be done across the Southeast. They’re not your cable guy, they are right in your community. They’re involved in the community and they’re there in quick notice to be able to help you do what you need to do. They’ve upscaled to be able to meet the challenges during this pandemic. So great place. They are offering all sorts of tools for free to be able to do online work, they’re HargrayFiber.com so this is, see how things can work for you.

Karl: [00:02:13] That’s fabulous. Well, today we’ve got an interesting topic. We wanted to, a couple of weeks ago, Rico and I were having a conversation as we were talking about how business people are figuring out ways to navigate some of the economic restrictions that have been put on businesses. And the topic of Barter came up. And for those of you that may not know much about Barter throughout the history and the present of it, we’ve got a fabulous guest here today. Laurie Sossa is the founder of the Southern Barter Club, and today we’re honored to have her on to help educate us a little bit around how Barter has been used and is being used by business owners to help them, not just today, during these economic times, but also how we can help people in their business, in particular, conserve cashflow. Hi, Laurie, how are you doing today?

Laurie: [00:03:11] Hey, good afternoon, and I’m doing well as well as can be. Thank you for having me as a guest today.

Karl: [00:03:17] No, we appreciate it. Why don’t we jump right in and start off by telling us a little bit about yourself and what led you down the path to discover and Barter as a business.

Laurie: [00:03:30] Well, my background is marketing, research and advertising. And we’ve worked with businesses that had products and services, and we were involved from the

beginning to the point where we helped them with marketing implications and recommendations and product launches and distribution. And we realized early on, especially manufacturer, everybody has their own costs of doing business. So there’s a lot of opportunity for leveraging. And so we realized early on that, you know, especially a business that’s just launching. That they could actually provide a marketing budget and expand it because if they leveraged something that they had the ability to earn at their costs of doing business, but yield the spending in the value of whole retail, it’s really a game changer. So early on, this is back in the nineties, we facilitated a lot of direct one-on-one trading, and I love the opportunity of being a resource to entrepreneurs and startups. Creating our own little ecosystem. But what we did realize is that there’s always a challenge. Have either, I don’t know if either of you or anyone you know, has ever done some type of barter. So that’s, that’s an interesting question because sometimes there’s a challenge of two people being interested in what the other person has to have to begin with, right? And also the value of being there. And so when we started seeing that, that’s when I decided, you know, I want to be a resource to entrepreneurs and to, you know, businesses, nonprofits that are cash strapped and take out of the equation, we call it the incidence of coincidence. You know, that’s when people actually have something that each other wants and that the value is there. And so we created our very own barter system, and 11 years later, it’s strong. And it’s not just here in the Southeast and Atlanta, but we actually have, several thousand throughout the state of Georgia and several thousand throughout the country. And we have reciprocation of 50,000 businesses around the world, that by itself…

Karl: [00:05:42] Wow. So I’m curious, how does Barter work typically? I’m a business owner and I need something in my business.

Laurie: [00:05:54] Well, the starting point is that we actually have what’s called a trade dollar, and it’s equivalent to what a US dollar is. And it is taxable. So in other words, the IRS sees the value of it. Our role as a barter organization and in the industry we’re called a trade exchange, by the way, the official terms in this $12 billion industry. And so we are the third party record keeper. So we manage all the debits, all the credits, and we utilize a trade dollar equivalent to what a cash dollar is. So a member is any type of business that has goods, services, resources, any type of underutilized asset that they otherwise don’t have a buyer for the cash. Or they have downtime and seasons and maybe not budgets but full cash. So it makes sense for them to bring it to a trade thing, such as SBC, Southern Barter Club where we’ll map the buyers and the sellers. So simply the people who participate are business owners. They’ve identified what services, resources, or assets that they want to make available and accept another form of currency in lieu of cash, in trade dollars.

Karl: [00:07:09] Got it. At a time like this where folks have been challenged with finding revenues and customers, can you give me an example of a typical trade that might happen?

Laurie: [00:07:25] Absolutely. Well for starters, we have what’s called a online platform. So just like all of us use day to day online banking, so you’re not going to go through the drive through right? Of the dry cleaners, or a fast food if, unless you’ve checked your balance right in your

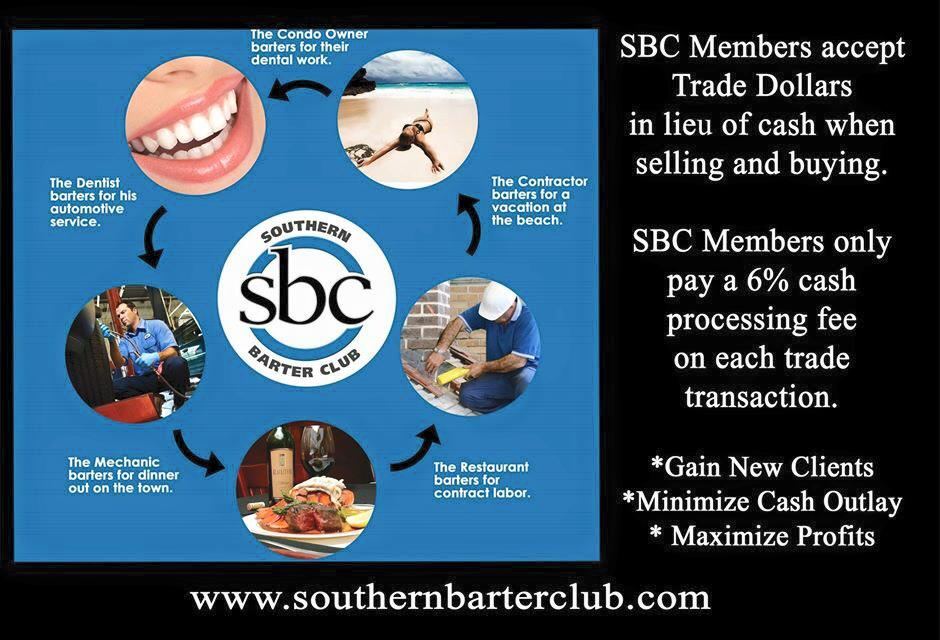

online banking account. So we haven’t, this is a little house on an online sophisticated, but very easy to use platform where members keep up with their trade dollars that they’ve earned. So the members simply just move past except what’s called these trade dollars. And they bank them and they may have something very specific in mind that they want to spend them on. Or they just bank them knowing that when the rainy day comes such as right now, unfortunately during this pandemic, that they’ve already been earning and building up and have this alternative currency in their account that they can tap into to offset spending cash to help grow their business. I did want to ask if we could put the slide up to show the model of how it works.

Karl: [00:08:28] Okay.

Laurie: [00:08:30] Okay, wonderful. So with that, how it works, it shows the SBC in the middle, so that’s our currency equivalent to one cash dollar is the trade dollar. And so a dentist can be contacted by SBC broker and tell the dentist, we have an automotive company that does car repairs and they want to be able to send one of their employees to get some dental work. And so the dentist may say, Oh, well, I don’t have any need. My son owns an auto repair service, so I don’t have any need for auto repair. That doesn’t end there. What he does say is, but I will accept your trade dollars. And so the automobile company now has to provide automobile repair maybe to the hotel owner or maybe to a restaurant owner, somebody else in the network that would want and need auto repair, and he accepts in lieu of cash, for the labor only not the product. He accepts in lieu of cash, trade dollars for the labor, puts it in this online account. Let’s say as an example he earned 1,000 trade dollars for labor on a transmission, let’s say for the restaurant owner. The restaurant owner already earned their trade dollars by letting the landscaper, the plumber and the hairstylist eat at their restaurants and in lieu of cash accepted trade dollars. So they’ve already banked their trades dollars. So now the restaurant owner goes to the automobile shop, thanks to SBCs directory and brokering services and says, we’d like to get $1,000 worth of transmission repair. Not the actual, you know, transmission, but the labor and the services. And so they’ve accept whats called trade dollars. For facilitating that SBC charges a 6% cash transaction fee. So now the restaurant has provided a thousand dollars worth of dining. But at a core restaurant their cost of doing business is maybe 28 to 30 cents on the dollar. I know you know that as a business advisor and a business coach and business consultant, everybody has their own cost of doing business, but the restaurant, it’s 28 cents to 30 cents on the dollar. So for them to provide $1,000 of gift certificates and $20 increments, that’s could be resold over time. In reality to fulfill it, it’s only going to cost them tops $300. Okay. But at the same time, they just say, thank you, SBC for bringing me that thousand dollars sale. Here’s your $60 cash fee processing fees 6% okay. And now they earned that 1,000 trade dollars in their virtual account. It cost them $60. In hard costs, it may have cost them over time to fulfill each time the person was using the gift certificate. It perhaps cost them that $300 let’s say for food. You know, but other than that, what’s happening is the pasta is boiling, right? The water is on, in the pot, the pasta is boiling. The lights and electricity are on. The waitstaff is there. We don’t want them twiddling their thumbs. So if we could identify for the restaurant certain times of the week, certain times of the month, that is good. Monday nights, it’s dead. Monday through Thursday during lunchtime, we don’t have a lunch crowd. We would like to

accept those certificates during those times. But we really don’t want to barter on Friday, Saturday, Sunday cause we’re jam packed, our tables are filled. But we would welcome, you know, not having empty tables Monday through Thursday. And so we’ll take barter for currency. And so there’s a lot of things happening there in bartering. They earned more power bar currency. Now they have a thousand dollars they wouldn’t have had otherwise of spending power, not cash, but barter trade dollars. But now they also have filled, you know, open tables in the restaurant. Their wait staff is going to earn their 20% cash tip because it’s tipping as always. Now, here’s the best part. Let’s say it was an attorney that purchased a gift certificate and took one of their clients to the restaurant. Well, we know what happens when there’s a job well done and a fantastic experience, right? They’re going to come back. They’re going to remember the great experience. And so what happens is word of mouth advertising naturally just happens. And the person or the business contact that the attorney had brought in for the meal, they don’t know if it’s participating in a barter system. They don’t know was paid with alternative currency. They just know that they were taken by their attorney to this restaurant and it was a great experience. And they’re going to come back. And so barter, at the end of the day, does help with word of mouth, advertising, marketing, branding, filling, you know, empty tables, helping get tips, you know, and some business for the staff that’s on hand, and filling their barter account with spending power. So now they’ve earned, and now they say, my employee needs dental work, or my employee needs a new transmission. So I’m going to spend that thousand dollars I just earned, and I’m going to go ahead and maybe go to the dentist or maybe go to the automobile company and get the repair done and use the barter dollars. So let’s say it’s only $500 in barter, simply a 6% transaction fee, $30 in cash, $500 in dental work, or the automobile repair. And now they still have left over $500 from their initial earning of the thousand barter dollars.

Karl: [00:14:11] So I’ve got a question for businesses today…

Laurie: [00:14:23] So how are businesses today using the barter during pandemic?

Karl: [00:14:29] What types of businesses? Services? What types of businesses would most benefit from this?

Laurie: [00:14:35] We have a directory that literally is A to Z. So anything from an art gallery, accommodations, acupuncturist, all the way to theater tickets, yoga, zoo tickets. So it’s literally an A to Z directory. Every business has capacity. So if there’s a dentist or a plastic surgeon or an eyelash extension company, massage therapist that has appointment times, if they’re not at full capacity, you know, if they have an eight hour day that they’re open and they have time slots that are empty, they can simply either call or alert, SBC Wednesdays pretty low, in us filling our bookings. Can you please send a blast out to your network and let them know that we’ll accept some clients and accept the barter currency. And sometimes it may not be that they reached out to us and that’s what our businesses love. It may be that we answer the phone and it may be the plumber who all along for the past several years, it’s his business model. He’ll, except when he has downtime at his convenience, when it works for him, you know, clients we wouldn’t have

had otherwise. Yes, I’ll perform the plumming. Banks online, this barter currency, and uses it as a spending power for when the needs come up. So it may be six months later when he realizes, Oh, you know, I need to go to the dentist, or, Oh, I need to, you know, reward my employees as a retention tool and give them tickets to a concert, or send a gift basket to a client. So this actually becomes a spending account. So it could become an account for business expenses. Some of our clients actually have stretched their marketing dollars, and have used their barter funds that they have received and been building up. And when it comes to, you know, some type of a marketing campaign, they will tap into their, their barter currency, get on a billboard without paying cash, use radio stations.

Karl: [00:16:31] I wonder if that’s something that folks can do today. If they don’t have the capacity, whether it’s a restaurant or massage parlour, in exchange currency for future services, or gift certificates to employees. They may be able to get marketing help, or accounting help from somebody else. Which would lower an expense that they would normally have for that.

Laurie: [00:16:59] Absolutely. It absolutely, it really is just business as usual, you know, provide your services, but just accept the help of an agency that is going to drum up the business for you. And it’s a different form of currency. You know, more than ever. We, I’ve never seen business like this before. I’ve been, we’ve owned Southern Barter Club, SBC Global Barter for 11 years. We’ve been running on seven days with brokering our clients. So we have, with the initial outbreak now things are the supply chains, a little bit improved, but we were getting panicked phone calls where, you know, we need hand sanitizer, we need free, you know, toilet paper and we need masks, facial masks, you know? You know, all these types of things that, because they would go to their supermarket, you know, and the shelves were bare. Okay. And they’d have to wait. And so we have done thousands, probably 10, 20,000 or more, you know, worth of transactions of our clients that we’re picking up and buying un-inflated prices. Very necessary, supplies. Hand sanitizer, facial masks, toilet paper, paper towels, things like that. That they otherwise maybe couldn’t even tap into back in March, by the way.

Rico: [00:18:28] Let me ask you, since you brought that up, about the, the price, because that’s always been a concern of mine with when it comes to barter. Two things, how do you sort of vet the members to make sure that they’re doing the right thing. And how do you make sure that these members, you know, if it’s a $1,400 transmission job, let’s say, that they don’t say it’s a $2,000 transmission job. Because I’ve seen that in other organizations sometimes where the price doesn’t make sense, and it’s still cheaper to go pay cash for it. So how do you protect the membership from those types of things that might happen.

Laurie: [00:19:08] That’s a good concern. And unfortunately, the reality is that there are people who attempt to do that. People are who they are in the cash world. If that’s who they are, and that’s how they do business, they’re that way in the barter world. What we do is we establish ethics where it’s according to the fair MSRP. So if there’s a business out there and you know, their price on the menu is established price on the menu. When you go with dine in that restaurant, that’s the established price. But if you’re going to hire a contractor. In the cash world,

you’re going to hire a contractor and they’re going to come to your home or your business and gives you a price to paint your home, and they tell you it’s $2,000. It wouldn’t be really prudent and really just, you wouldn’t be a good consumer if the first person you just called randomly, you’re going to say, yes, I’m going to pay you $2,000 cash to come paint my house. So there’s an obligation that goes back on the buyer to do their due diligence themselves. We’re a directory, just like the yellow pages has always been for those of us who remember the yellow pages, it was delivered. So we house the directory and we do all we can. We do actually employ, since that’s my background, mystery shopping. So if somebody calls with a concern that like this dry cleaner, this happened actually, we had a dry cleaner in Buckhead that was for years clients of ours. And everybody was happy with their services, but it did take one client that out of there, for whatever reason, out of their little area that they, that they lived in, out by Toko Hills decided that they needed to go into Buckhead. And so they looked in the directory and they went to a dry cleaner in Buckhead. And they came back and they were astonished and they said, what? I’m paying, you know, such and such for my dry cleaning. And why is it so much more expensive there and they’re using the barter system? So we hear what our clients say and we don’t just leave it at that. So what we did was we sent a mystery shopper. So we sent someone who actually went in and they said, Oh, I’m new to the area and I’m going, you know, and I would like to be using for my husband’s shirts. You know, apples to apples, you know, what it was going to be was laundering and dry cleaning of shirts. And, you know, we’re interested in knowing what your prices are and I just wanted to introduce myself. Can you write it down for me? And it was right on his, he also happened to own a gym. And he had some, like trifles or whatever for the gym, can you write it down for me? And he wrote it right down on there. And we found out that the prices were exactly what the prices were. He was Buckhead rent, so the prices were a lot more expensive than the Toco Hills area where he was getting his shirts done. However, I do want to say that several years later, a different company, the same exact thing, a concern happened in Buckhead. And we would, we were actually, well maybe it’s the same thing. It’s Buckhead rent, but three different people brought it up. We sent somebody and sure enough, they had pricing written on the board, you know, behind the counter. And it was like 50 something cents more. And so they were changing the prices and we told them that he needed to do fair trading. And he had all the reasons why he felt justified. And we just said, well, we can’t bring you new clients. We’ll help you spend out your account and close your account. And that’s what we did. So when it’s brought to our attention, we don’t ignore it. But the only way that we can fix the problem is if it’s brought to our attention. So we have a rating system. So when you have done a transaction, finished a transaction at a rate, the person that you just traded with at one to five star. And you know, accountability is a big thing. Knowing that you know the person. I do want to give one other example. We had a Mexican restaurant in Lawrenceville, Gwinnett County that wanted to have the vestibule built and they had received cash prices because again, we always tell everybody. Don’t just go with the first price that somebody puts you in barter, like do your due diligence and get several quotes, you know? So if I’m going to get my house painted or I’m going to build a vestibule, I’m going to get at least three quotes. And if it’s too low? Hmm. Something to think about, right. If it’s too high, well, I don’t want to be taken advantage of. But if it’s right in the middle and it sounds right then that may be. And you have to take into other considerations is, are they using contractors? Are they using

employees? Do they have a warranty with their work? So this Mexican restaurant had, actually, picked up day labor and that’s how they wound up getting their, their vestibule built. So it was different people that were working on it different days, and there was no warranty. And it wasn’t apples to apples when they compared the price that was maybe double the price, but it was with an established company that had employees and it did have a warranty. So, we just have to put the responsibility back on the buyer. Just business as usual in cash business. I’m not going to just go with the first quote. I’m going to get two or three and be an informed consumer.

Rico: [00:24:21] And I like the fact that you have reviews on there and the star rating because transparency, right? Because everyone knows it’s not like, just it’s like there’s the company name attached to the account. So if there’s good transparency, so they’re getting a review and it’s a bad review, whoever is saying it is standing by it. If it’s a great review, they’re standing by it.

Laurie: [00:24:48] Absolutely. One of the things I did want to manage expectations, and I think it’s a simple, very simple illustration, but I think it really does hit home is, if anyone has ever gone into Macy’s as an example with their mindset, I want a size large, Navy Ralph Lauren sweater. Right? They can go into Macy’s or any retail store, and if they’re going to pay full retail, they’ll get a very big variety of sizes, brands, and available options, right? Different experience if I head over to the clearance rack. I still want the Navy blue, Ralph Lauren size large sweater, but it’s only $20 it’s discounted patch. And I’m looking on that rack and I see black, not blue, but then again, it’s$20, it’s on the clearance rack. I’m not paying a hundred retail or I see Calvin Klein, not Ralph Lauren, but it is Navy blue and large and it’s $20 so that’s how I like to manage expectations in our network is we are a clearing house. So it would be unreasonable to think that I’m going to get something on barter when cash is king and it will always be king. You know, it’s an incremental opportunity to hold onto your cash, minimize your cash outlay, and you’ve earned it the same way. So wouldn’t be fair for a hotel owner as an example to say, no, we’re not going to barter on 4th of July and let you book it six months in advance. They wait to the very last minute when they realize that otherwise goes unsold for cash because that becomes perishable, right?

Rico: [00:26:33] As long as you’re setting expectations, that makes sense. People should understand that.

Laurie: [00:26:38] Yes, absolutely.

Karl: [00:26:41] So I’ve got a question. What are the challenges of people? Why don’t more people do this nowadays? I mean, obviously cash, but what do you see as some of the reasons why people don’t find ways to barter more?

Laurie: [00:26:55] I think the biggest, the two biggest things is number one, not knowing that they even have the ability to do it within a structured professional setting. So, you know, somebody could say that, I want you to build me a website and I’ll give you haircuts. And

oftentimes they’ll go ahead and build a website and then the place goes out of business and they’re stuck without payment, you know. And they got the short end of the sick. It also could be the situation where they don’t need a haircut, their daughter owns a salon. So I think most of the time there’s a brick wall when it comes to barter, where they don’t, where most consumers and business owners don’t realize that everybody has capacity. Everybody has something that they really could leverage. Time, talent, resources, something that’s even sitting, collecting dust or locked up in a storage or basement. So even though we’re a barter network for businesses, everybody has their core business that they provide and something in there. Not everything, by the way, like I haven’t in Buckhead, we have a center that will do laser hair removal and tattoo removal and weight loss. But they’re very clear that they do a hundred percent barter. They list everything in the directory, and we will recommend those services on a hundred percent barter. So everybody has to provide something at a hundred percent barter. However, they don’t have to provide everything at a hundred percent barter. So they list that we do. If you go to my website, you’ll see we do Botox and other types of services, but we’re not going to do Juvederm and Botox on barter. Now, if we don’t have that otherwise available on barter, and someone says, Oh, I see that that’s what they do, but I want it on a hundred percent barter. We could let them know that look, anything else that they do on a hundred percent barter or take advantage of it, they’re playing by the rules because they offer all these things on a hundred percent barter. If we can’t source it for you on a hundred percent barter, you can make an offer and ask them, can I do it with 50% with my barter currency, and then at least compensate you since you didn’t enter this in your profile as an offering. Can I, you know, can you accept 50% in cash? And so that’s not our practice, but it does happen on occasion and we’re fine with that when they’re already offering something else on full barter.

Karl: [00:29:23] One of the things I think that I, that I think that I’m hearing, I want to highlight that business owners today that might be struggling with what fundamentally is demand for customers, but they have capacity. Is this something where they can at least for a period of time, offer up some of that excess capacity, bank up barter dollars that as things return to normal. They may back up how much, you know, their capacities are to fill up, but they have barter dollars that they can use to fulfill other expenses in their business. Is something like that possible?

Laurie: [00:30:02] Absolutely Karl. So right off the bat, anyone that needs help in whatever way, so they need clients that, you know, maybe they have their brick and mortar, that everything has always been done brick and mortar. Maybe it’s an, I don’t know, but let’s say it was a some type of a yoga exercise class and now they can’t do that okay? So if they were in the barter system, and they have no barter dollars, and they now realize, wow, I have to figure this out, I have to adapt and integrate a new way of doing business. So now we can say to them, well maybe you have something here where you can now offer your yoga classes online. So let me introduce you to a company that can build an app for you. Let me introduce you to a company. That could, you know, build your website or produce your videos for you. You know, and now advertising that you can have on the radio that’s saying that, you know, we have virtual yoga classes, and they could just cash out them and to have entrance to be able to, now, you know, all do this

together. I’m again, just thinking a little bit outside the box, trying to make it an example, but if she doesn’t have barter dollars she’s already earned, that’s okay. We at, during this pandemic, we’re giving lines of credit. So during this pandemic, she could now say, you know, if I need $5,000 SBC, we can give them a line of credit for $5,000 and how are they going to pay me back? Well, they’re doing virtual classes for yoga, then let us promote it. And if you have capacity for 12 people online to be on your yoga class and they’re paying you cash to be in that yoga class, can you take two people that will pay you in barter dollars? And we’ll fill that class up with the two people on barter. And then when things settle and to the new norm, and there’s other ways that she can earn the barter, we’ll help her come up with the ways of paying back, you know, that. And she could think outside the box and say, well, you know what? Yoga is my business that’s struggling. I need to get that up and running. But, you know, I also sell Mary Kay cosmetics. You know, I also, you know, can do tutoring. Like we’ll help them think outside the box and tap into and leverage resources.

Karl: [00:32:13] That’s fabulous. Well, we’re coming to the end of our time and I just wanted to ask if people have questions or wanted to learn more, how can they reach you?

Laurie: [00:32:24] So our website is SouthernBarterClub.com and SBCGlobalBarter.com. And so they could email us from there. Our office number is 678-547-0900. And so they can call, send a message and set up a complimentary consultation. And we are here for the community. So, you know, if this is a time, more than ever, that we have to really just be a resource to one another. We also, you know, I mentioned to you, we’ll give lines of credit, but we’re also, with the membership fee, we’re doing it at 50%, so it’s normally 299. But they said we had created a code called, CSage and yes, thank you. And so that’s 149 instead of the 299. So definitely, what I’m hoping that everybody gets out of this more than anything is even if they don’t work with Southern Barter club, start slowly even with just leveraging what you have, your time, your resources, your assets, and don’t be afraid to approach another business owner you want to do business with. That’s your neighbor or colleague or someone you’ve always worked with. Because no commerce at all is, you know, a big difference from, well, look, I could give you this or I could, you know, and there’s some activity going on and you’re not stuck and staying in stuff. So if anything, we hope there’s an awareness to bartering and trading.

Karl: [00:33:56] Sure. Well, I want to, I want to thank you very much, Laurie, for joining us. It’s Laurie Sossa the founder of the Southern Barter Club. Just exploring different ways that businesses can pivot and find ways to use their capacity and skills to earn a different type of dollar, barter dollar that they can use in other ways going forward in their business. So keep their employees engaged, find ways to reward people. And I liked the example you gave, you know, maybe building out a new capability on online sales now for future exchange of services where you could use the barter dollars for something else to cover an expense in the future. So really good tips and just wanted to let people know there’s so many different options in how to navigate and pivot through this pandemic. Thank you very much for that.

Laurie: [00:34:54] Absolutely. Thank you for having me on as a guest.

Karl: [00:34:58] You’re absolutely welcome. I’d like to say I’m Karl Barham with Transworld Business Advisors of Atlanta Peachtree. We’re here to help business owners figure out ways to improve the value of their business so they can successfully exit it when the time is right. We help with selling and buying businesses. Rico, why don’t you tell us a little bit about what you have coming up and going on?

Rico: [00:35:20] Sure. So I publish Peachtree Corners magazine and you’ll, we are in the midst of writing stories for this upcoming June – July issue. That’s going to be out, hitting the post office on June the fifth. So it’ll be out for that June, July. Good solid run issue. Similar to what we did last issue. We’re still printing, we’re still mailing 18,800 copies every household, in the city of Peachtree Corners, and then some are like Norcross. So some good stories we’re working on about how people are handling this situation, how they’re opening up their business and some of the stories as well in there. So we’re doing that. And I’ve quite frankly, I’ve been busy too, Mighty Rockets, my company that does digital marketing, and we’ve been been picking up several company Facebook pages, LinkedIn pages to manage. We’ve been doing a lot of video work through these video chats. And creating good, some good quality video content for companies, even doing it online like this. So it’s worked out really well. So I’ve been busy. I am thank thankful, for the way it is and thankful for all the other people working in this stuff so that we can all stay busy.

Karl: [00:36:34] Yeah, absolutely. Well, I’m just impressed while people are working together to get through this. So continue doing that. Stay safe, everyone and I think as you take some of these advice and tips, find ways to pivot your business, stay successful. Thank you. Have a great day.

Related

Kendra Scott is celebrating the opening of its newest store in Peachtree Corners the weekend of May 10 at The Forum.

Upon opening, the 2,263 square foot store will display Kendra Scott’s current collections. The store will also showcase the brand’s unique Color Bar, offering shoppers an interactive experience to create customized jewelry in minutes and leave with it in hand.

Worn by celebrities including Hailey Bieber, Camila Cabello, Mindy Kaling, Zendaya and Kelly Clarkson, Kendra Scott’s collections are known for their custom-created stone shapes, genuine materials and design details.

This will be Kendra Scott’s first store in Gwinnett County, which joins five other retail locations in Georgia.

The brand will continue to show its support for the community through partnerships with non-profits and local businesses. For the grand opening weekend, Kendra Scott Peachtree Corners will host various non-profits for Kendra Gives Back events, donating a percentage of proceeds directly back to the causes.

Kendra Scott hosts more than 10,000 Kendra Gives Back events in retail stores annually and looks forward to establishing relationships and connecting with the Gwinnett County community.

“We’re excited to continue introducing the community to new brands, bites and events at The Forum as part of our vision to create downtown Peachtree Corners. Kendra Scott will be a welcome addition, providing our guests a top-notch experience to shop its unique offerings in person,” said Charlotte Hinton, The Forum marketing manager.

Doors will open on Friday, May 10, at 10 a.m. with celebrations throughout the weekend, including giveback events, gifts with purchase and giveaways. RSVP for more details here.

Upcoming events:

- Friday, May 10 from 10-12 p.m. – Kendra Scott Peachtree Corners is partnering with The Forum for a VIP event. Supporters who spend $100 will receive a special jewelry gift with purchase.* Guests will also enjoy refreshments from Giulia, The Italian Bakery.

- Friday, May 10 from 5-7 p.m. – Kendra Scott Peachtree Corners is partnering with the Norcross High School Cheer Team and donating 20% of proceeds. Supporters who spend $100 will receive a special gift with purchase* Guests can also receive a custom embroidered bow from Quiet Hours Embroidery with purchase.

- Saturday, May 11 from 4-6 p.m. – Kendra Scott Peachtree Corners is partnering with Spectrum Autism Support Group and donating 20% of proceeds. Supporters who spend $100 will receive a special gift with purchase.* Guests will also enjoy complimentary cotton candy from Wonder Soirée with every purchase.

- Sunday, May 12 from 12-2 p.m. – Kendra Scott Peachtree Corners is celebrating the Community of Motherhood. Supporters who spend $100 will receive a special gift with purchase.* Guests will also receive a complimentary Mother’s Day bouquet of flowers from Nancy’s Flower Truck.

*One per person while supplies last.

Kendra Scott Peachtree Corners is located at 5155 Peachtree Parkway, Suite 710 in Peachtree Corners at The Forum. For companywide updates and product details, follow @kendrascott on Facebook, Twitter, and Instagram.

Related

Business

BRACK: Peachtree Corners to lose Peterbrooke Chocolatier

Published

1 week agoon

April 19, 2024

Peachtree Corners will soon lose one of its most iconic, popular and tasty businesses.

Peterbrooke Chocolatier, run by Geoffrey Wilson and Scott Gottuso, has been told by Peachtree Forum landlords, North American Properties and Nuveen Real Estate, that its lease will not be renewed. The last day of business will be July 25.

Meanwhile, Peachtree Forum is getting several new stores. They include Kendra Scott, Sucre, and The NOW Massage. Previously announced were Alloy Personal Training, Cookie Fix, Gallery Anderson Smith, Giulia, Lovesac, Nando’s Peri-Peri and Stretchlab. Wilson adds: “We are not in their big picture.”

Wilson has operated Peterbrooke at the Peachtree Forum for 14 years and Gottuso has been there nine years. They have made the chocolatier profitable and doubled sales. Wilson says: “We turned it around through community involvement and made relationships. We worked with the schools, gave donations, did a lot in the community, and made a difference. We produce most everything we sell in the shop, so it’s labor intensive. We make European-style chocolate treats from scratch from the very best ingredients, package it, make gift baskets, and also sell a lot of gelato.”

Key items include truffles, hand-made caramels, cherry cordials, chocolate-covered cookies and pretzels and strawberries hand-dipped in their own blend of chocolates. (They are all good!) One of Wilson’s and Gottuso’s most iconic products is chocolate popcorn. Once you try it, regular popcorn is tasteless. “We sell a lot of it.” Wilson adds: “Gelato sales have carried us in the summertime, since there are not many chocolate holidays in the summer.”

Peterbrooke now has five employees, and would like to have 10, but it is difficult to hire people with the skills in chocolatiering. A key part of its business is corporate companies, such as Delta Air Lines and Capital Insight. The Peachtree Corners’ Peterbrooke has corporate customers as far away as Cleveland, Ohio.

The operators were surprised when the Forum owners did not renew its five year lease. “The big decisions were made in Charlotte or Cincinnati, not locally,” Wilson feels. “We were no longer in their big picture. They want new and glitzy, shiny, fancy and trendy.”

The operators plan to start their own chocolate company, to be called “Scoffrey,” and initially sell online, plus have pop-up locations during holidays, and possibly have a booth in other merchants’ stores on occasions.

“Whatever we do would look different. We might rent a space somewhere close by so that people can still have the good chocolate experience with us, but we won’t have a regular audience walking by.”

Another element: the price of chocolate futures has spiked this year, with a bad crop production year. Wilson says: “That is key to our business and a huge cost increase. That doesn’t help.”

Wilson adds that the forced closing of the Peterbrooke location “is something like the death of a friend. But you go to the funeral and to the wake, and in six months or a year, It won’t be so bad.”

Have a comment? Send to: elliott@elliottbrack

Written by Elliott Brack

This material is presented with permission from Elliott Brack’s GwinnettForum, an online site published Tuesdays and Fridays. To become better informed about Gwinnett, subscribe (at no cost) at GwinnettForum

Related

Business

North American Properties Revitalizes Avenue East Cobb

Published

1 week agoon

April 16, 2024

North American Properties (NAP) has revamped the Avenue East Cobb shopping center in Marietta, boosting its appeal to suburban residents seeking a more urban lifestyle. Now, it’s being honored as part of the Atlanta Business Chronicle‘s “Best in Atlanta Real Estate” coverage.

NAP is known for transforming properties like Atlantic Station, Colony Square and The Forum.

According to the Atlanta Business Chronicle, the redevelopment involved demolishing part of the main building to build a public plaza with a stage surrounded by restaurant patios.

A new concierge facility was also added, including a canopy for drop-offs. Additionally, smaller retail buildings were created for standalone tenants. The business mix was updated to include names like Warby Parker, Lululemon and Peach State Pizza.

NAP also increased community engagement by partnering with at least 10 local organizations for social events. These efforts have proven successful. Over the last two years, Avenue East Cobb has seen a 36% increase in sales per square foot thanks to a major rise in foot traffic.

More news from North American Properties can be found here.

Related

Read the Digital Edition

Subscribe

Keep Up With Peachtree Corners News

Join our mailing list to receive the latest news and updates from our team.

You have Successfully Subscribed!

Exploring Israeli Innovation in the Smart City Sector with Einav Gabbay [Podcast]

Georgia United Methodist Foundation Announces Changes to Finance Team

BRACK: Peachtree Corners to lose Peterbrooke Chocolatier

North American Properties Revitalizes Avenue East Cobb

Spring Voting Will Determine Important Gwinnett School Board Elections

Local Non-profit Boy With a Ball Announces Dates for Upcoming Conference

Kendra Scott Opens New Store At The Forum

Kendra Scott Opens New Store At The Forum

Local Non-profit Boy With a Ball Announces Dates for Upcoming Conference

Spring Voting Will Determine Important Gwinnett School Board Elections

BRACK: Peachtree Corners to lose Peterbrooke Chocolatier

Georgia United Methodist Foundation Announces Changes to Finance Team

North American Properties Revitalizes Avenue East Cobb

Exploring Israeli Innovation in the Smart City Sector with Einav Gabbay [Podcast]

North American Properties Secures 3 New Brands for The Forum

Light up the Corners [Video]

Capitalist Sage: Business Leadership in Your Community [Podcast]

Cliff Bramble: A Culinary Adventure through Italy

Top 10 Brunch Places in Gwinnett County

A Hunger for Hospitality

THE CORNERS EPISODE 3 – BLAXICAN PART 1

Top 10 Indoor Things To Do This Winter

The ED Hour: What it takes to Remove Barriers from Education

Peachtree Corners Life

Topics and Categories

Trending

-

Faith1 week ago

Georgia United Methodist Foundation Announces Changes to Finance Team

-

Business1 week ago

BRACK: Peachtree Corners to lose Peterbrooke Chocolatier

-

Education3 days ago

Spring Voting Will Determine Important Gwinnett School Board Elections

-

Doing Good2 days ago

Local Non-profit Boy With a Ball Announces Dates for Upcoming Conference