Business

How to negotiate and what to look for before signing a retail or commercial lease

Published

2 years agoon

One aspect of real estate that is supercritical to business owners is leasing. Here to talk about the ins and outs of leasing is Mario Mireles, Principal of CLR Real Estate Management. Mario has years of experience working with landlords, tenants, negotiating, and creating leases that are win-wins for both sides. On this episode of the Capitalist Sage, Karl Barham, Rico Figliolini and Mario discuss tips for working with commercial leases, what to look out for in the fine print, and much more.

Resources:

Mario’s Email: Mario.Mireles4@gmail.com

Mario on LinkedIn

Timestamp:

[00:00:30] – Intro

[00:03:18] – About Mario

[00:04:24] – The Business of a Landlord

[00:07:14] – What Affects Vacancies

[00:09:32] – Creating a Third Place

[00:12:53] – Choosing the Right Space

[00:16:53] – What to Pay Attention to in a Lease

[00:19:42] – Negotiating Different Leases

[00:27:04] – Identifying Risks

[00:33:02] – Lease Renewals

[00:39:49] – Closing

“The two things to consider is, get a business plan. And then decide, or really do your homework in terms of who your co-tenants are. Is there a merchandising plan? Look at the occupancy in that shopping center, is it 50% leased?… Once you’ve answered those questions or to the best of your ability, then you begin to ask rent questions… And we all know this, whether you’re buying a house, whether you’re buying a car, don’t fall in love with any location.”

Mario Mireles

Podcast Transcript

[00:00:30] Karl: Welcome to the Capitalist Sage Podcast, where we’re here to bring the advice and tips from seasoned pros and experts to help you improve your business. I’m Karl Barham with Transworld Business Advisors and my co-host is Rico Figliolini with Mighty Rockets, Digital Marketing and the publisher of the Peachtree Corners Magazine. Hey Rico, how are you doing today?

[00:00:48] Rico: Hey, Karl. Good, how are you?

[00:00:50] Karl: Doing great. Spring looks like it’s here. It’s a beautiful day outside and I’m excited to talk about our topic today, but let’s start off with our sponsors for today’s episode.

[00:01:02] Rico: Sure. So the sponsor of all these podcasts is Peachtree Corners Magazine. We just came out with our latest, Best-Of issue that was a reader survey. Had over 1900 respondents to that. So it was a great survey. I think it’s a great issue actually. We’re right now, working on our next issue. So there’s a lot more to come. You should check that issue out probably in about another, I think it’s going to be another six weeks or so, it’ll be out there. But otherwise go to LivinginPeachtreeCorners.com. We are doing a lot more online articles and content. Talking about local stories here and our last one that just got uploaded this morning is about the Pedestrian Bridge that was just re-colored in the city of Peachtree Corners to Ukrainian colors of the flag. So we have some interviews with some local Ukrainian people and you can find that online this afternoon actually.

[00:01:51] Karl: Awesome. Great, great content and just also keep aware of events that are happening, everything that’s going on locally visit the website and check out the magazine. So great job again, Rico. I got a few good recommendations from it. So we’ve been trying some new businesses here locally that we hadn’t known about before. So, great time to support local businesses and meet some of the other members of our community. Well today, we’re going to talk about one aspect of real estate that is super critical to most business owners and that’s talking about leases. And today it is my pleasure to welcome our guest Mario Mireles. He is the Principal of CLR Real Estate Management. With years of experience, both working with landlords and working with tenants and negotiating, creating leases that are win-wins and successes for both sides. And today we’re going to discuss tips for working with the commercial leases for small businesses. Anyone that’s been a small business owner with a brick and mortar location or an office or industrial knows that working with landlord leases can be challenging. And so today we’re going to talk a little bit about some things that you can consider, think about, and do whether you’re going for your first lease for a new location and, or renewing a lease at a current location. So, Mario, thank you so much for joining us today.

[00:03:15] Mario: Thank you. It’s a pleasure to be here guys.

[00:03:18] Karl: Why don’t we start off with, just tell a little bit about you and some of the stuff you’ve done in your career to assist both small business owners and tenants in the commercial leasing world.

[00:03:28] Mario: Overarching, I’ve been in the commercial real estate industry since last century, I like to say. And primarily started working in the enclosed regional mall space. As everyone knows, that’s changed significantly with what’s going on in the retail world, especially in the last 10 to 15 years, pandemic aside. But in that process, I’ve also worked in grocery anchored real estate, open air centers, some high rise office commercial business district, office buildings, as well. And in as much as landlords all want to deal with national tenants, large, big boxes or small spaces, whether it’s in a grocery anchored center and franchises as well. Really, the lifeblood of these shopping centers is the small business. So I’m glad to share some tips and discuss some of that with you today.

[00:04:24] Karl: Oh, excellent. Well, let’s jump right into it. And maybe for folks that are sitting kind of on the outside, can you share with us kind of the business model of the typical landlord for a commercial space. Let’s say like a strip center or something like the Forum where there’s a group, a couple of anchors, and a group of small. How is it that they make money? What are they thinking about when they’re setting up that business?

[00:04:51] Mario: Well, those are two different asset classes, so starting with the small, I’m going to call it the grocery anchored business, which are plentiful around Peachtree Corners. The landlord will first and foremost attract an anchor, and typically that anchor in a grocery anchored business is grocery anchored, of course. And many, many brands come to mind for that. I’m not going to call it a loss leader, but of course the landlord is giving a lot away in terms in lease and cost per square foot for something that’s going to drive the business. What keeps that shopping center afloat are the small shops. So certainly there may be a demand for the UPS store or the Papa John’s pizza, or those type. But then the rest of it has got to be filled by the local florist, the local tailor, the nail salon, and so forth. So that’s what drives the income stream for the landlord. Now they all have different reasons as to how they’re going to operate that in the long-term. By that I mean, are they a build and hold developer? Do they purchase the property because it’s value add? Meaning they’re going to increase the rents, increase the occupancy, or are they going to flip it? Do a couple of things to it, throw some paint on it, fill it with short-term deals. Or are they going to refinance? The way we do our residential homes. After a period of years, there’s some equity in it. They’ll refinance, and they’ll use that cash to go build another shopping center or purchase another shopping center. The Forums and the open air centers are an entirely different beast. Certainly the underpinnings of the business model are the same but on a much larger scale. And you absolutely need more national tenants, or what we call credit tenants to fill those spaces. So whether, the Forum in particular, whether it’s Belk or Home Goods. Pottery Barn comes to mind, some fast casual restaurants, Chipotle, Jason’s. Those all help drive traffic, but you really need to back fill it with some strong, local tenants. And of course there’s all the other moving pieces, right? Occupancy, rent, location, ease of parking, types of uses, and so forth. But that’s generally what is going on. And again, it depends on the landlord’s business model. Is this a core property they’re going to keep? Or is it something that they’re looking to turn over? Are they looking to fill it and refinance to make improvements, and so forth.

[00:07:14] Karl: So I’m curious to just explore a little bit on some of those retail spaces. If you drive around outside the perimeter Atlanta, in various areas from Alpharetta, Peachtree Corners, Norcross, you will see a lot of plazas that have what would be considered a higher number of vacancies than traditionally. Can you share what’s been happening in the market or in the economy that’s driving what appear a lay person, more vacancies and how is it impacting landlords in particular?

[00:07:47] Mario: Interesting question. I think that the pandemic stands out. The last 24 months, 23 months in clock ticking, have certainly affected occupancy for both anchor-less shopping centers, that is just strip centers with a bunch of small shops in it. Or centers with an anchor in it as well. And for the large open air properties, whether you’re an open air property like the Forum or the mall. And the occupancies are a direct result of foot traffic, a direct result of sales. There’s no other way to put it. And landlords, in many cases, if they have the resources have bent over backwards trying to adjust rents. I’m not saying give away and reduce rents. What they do is they take those rents and they move them to the end of the term. So if they reduce your rent 50%, they take that 50% reduction and add it onto your last couple of years, or they extend the lease by a couple of years. But you’ve gotta be a credit worthy tenant with a good track record to get that. And ultimately, that leads to vacancy sometimes because there’s no negotiation and the tenant falls behind. There’s just no way that they can survive. The last piece, Karl, is that retail has consolidated tremendously and you can look a little bit at online and how that’s been a disruptor. But that along with the pandemic, along with a lot of small businesses that are, it’s capital intensive and they don’t have a lot to fall back on. Landlords and whether or not they have the opportunity or whether their lenders are screaming, not allowing them to reduce rents. All of those things, and I know I’ve said a lot, affect the occupancy in any kind of shopping center.

[00:09:32] Rico: Let me ask you something on the, I know you’ve worked with Phipps Plaza, Atlantic Station. You were general manager of those places some years back, along the Perimeter mall, North Point as a regional person. I’m thinking particularly, Phipps Plaza, Lennox mall rather, they are filled to a degree. They have people going to it. Now, there is density around that type of mall. An open air like here, there’s no density, right? Not really, you know, when you think about it. A lot of single family homes and stuff, the demographic doesn’t quite fill. Does that affect the retail? Because I’m seeing more of the Halcyon’s, more of the places where you have multi-use. You have retail that is surrounded by apartments. Do you see more of that happening to these types of places?

[00:10:21] Mario: I do. And to kind of backtrack on your first comments, I would argue that while there is the potential and has been density. When I was running Phipps, twenty-five or 30% of Fortune 500 companies were represented in that Buckhead market. So daytime traffic was literally a hundred thousand people, 200,000 people that that place would grow by. Weekends because they had a critical mass of terrific retailers, a whole different time when I was there, that created a constant cycle the fed itself. The best retailers, daytime density, hotels, a center of commerce and so forth. But as things have changed, you know, traffic is an impediment sometimes to success, right? You can be too successful. Too dense, right? So you end up, in those situations, with also customer preferences changing a little bit in terms of, how many teen stores do you really need in an enclosed mall? How many shoe stores, how much urban wear and so forth. And it just, the list kind of goes on and retailers have been slow to adapt in that sense. And it’s been a tough 20 years. If you think back 15 years ago, when the bottom fell out in the recession, the great recession, that caused retailers growth plans to cave and rents fell down and so forth. You recover from that and the world is changing a little bit with online retailing, then the pandemic hit. So retailers haven’t been quite as nimble, in that way to recover. And to your point on the Halcyons of the world, or even Avalon and so forth. A lot of these cities realized that a third place, and that’s something that I’m stealing from some of my peers in the business. Creating a third place, first where you live, second where you work, third where you play. That’s your third place and where can you do that? Well, Avalon successfully did that. They’ve tried to create, the same developers tried to create the same thing down on I think, 14th and Peachtree at Collins Square in the middle of a, that’s very dense. But Halcyon, they want people to go spend time and be entertained. So you’ve got dining, you’ve got entertainment in the form of theater, you’ve got green space. The only thing that people complain about first and foremost is parking. Because they, you know, that can be a sign of way too much success too quickly. But all that being said, Rico, that’s what they’re looking for. And these cities want to keep you from traveling, you and I, to keep our dollars local and that’s what they’re all working for.

[00:12:53] Karl: So let’s build off of that for the small business owners. Let’s say I’m a small business owner and I’m trying to make a really critical decision. Now let’s say I’m a retail type business where foot traffic matters in my business. What would you advise me to consider when trying to decide to be in, what might be a more expensive location with what the anchors and the foot traffic versus some of the secondary strip mall that may not have the same level of foot traffic? How much impact on my revenue can that have? What’s, give me a range. Do you have a range or is there a way I can think about that to help guide that decision?

[00:13:32] Mario: I think the first question that a lot of small businesses would ask me when they’d look at leasing in a grocery anchored or an enclosed mall would be, what’s the rent? My answer would be that ultimately turns out to be, it’s not a minute percentage, but depending on your sales is really, I would say, what are your sales goals? How much do you think you can do? Why do you think you can do $500,000 your first year? And if that’s the case, here’s what the rent for that space is. And, you know, you can argue a little bit, it’s like tipping your hand to the landlord, but you have to present a business plan. You can’t just say, okay, the rent is twenty-five dollars a square foot. Or twenty-five dollars all in including cam charges, insurance, marketing, and so forth. And my utility charges are X and my insurance charges are X and then say, okay, I need to do six times the rent, ten times the rent in order to be successful. There, there is a difference, but it all depends. Is it an anchored center? What’s the foot traffic? And I think the two things to consider is, get a business plan. And then decide, or really do your homework in terms of who your co-tenants are. Is there a merchandising plan? Look at the occupancy in that shopping center, is it 50% leased? I don’t care if they have a Publix. Or is it 80% leased and has perhaps an Ingles instead of a Publix. Those are all of the things. I think you and I spoke some time ago about, what kind of business. Is it a service business? Is it a fast casual food business? Is it going to compete within, you know, five minutes of another use that you have that’s similar. Is there a hole in the market? Once you’ve answered those questions or to the best of your ability, then you begin to ask rent questions. What’s it going to cost me to go into, A, B, or C shopping center. And the last thing, and we all know this guys, whether you’re buying a house, whether you’re buying the car. Don’t fall in love with any location. That I think is hard. Because the emotion starts to pull on you, because look at all these people. But they may not be the people who come on a Saturday and bring their couches in for reupholstering. Those are the, those are the kinds of things that you have to consider.

[00:15:56] Rico: You know what, that always bothers me when I see certain businesses in certain areas opening. And I think they choose to open in an area because the rent’s low. But the ir cupcakes are $5 a cupcake. And people may not go there for that $5 cupcake, because that’s not the demographic visiting that shopping center.

[00:16:16] Mario: Are these tenants impulse? Is your small business an impulse like a cupcake or a cookie? Or as I said, is it a service, is it a weekday service? I think it’s complex. It’s very difficult. And I’ll say this, I believe in small businesses. I believe in entrepreneurism. I believe in the American dream. I just think that it’s very, very difficult for people to separate the emotion related to the things I just talked about and wanting to be their own boss or wanting to sell widgets and making a business decision that’s the best for their use, their location, their potential sales.

[00:16:53] Karl: I’m wondering about kind of jumping into some of the nitty gritty of a new lease. What can you share with business owners when they’re looking to sign their first lease? What are some of the parts of the lease they should pay more attention to? What are some of the gotcha things that people may not expect that’s in typically people’s first lease?

[00:17:14] Mario: Certainly rent is first and foremost on people’s mind all the time. But there are so many other things. There’s what I call the business points in a lease and the boiler plate. The boiler plate talks about what your insurance coverages should be. And at what limits they should be. It talks about force majeure, which is a fancy way of saying, simplified version, act of God in a lease that no one could have anticipated. It talks about a number of things and basically what you have to do, when you have to be open, when you can close, what you can sell and so forth. And then there’s the business points, the rents, the additional charges, the opening date, which isn’t always as straight forward. It might say 90 days after possession. Well, when does possession start? There are discussions about rent increases. Overarching to that, my comments, read your lease, read your lease, read your lease. And there’s always tension. Business tension between a landlord and a tenant. It’s just the natural order of things. Find an expert in small business or someone who’s done it, or a trustworthy attorney, a business broker that you can work with and walk through these points. Back to your question, are there rent increases in the lease? Not just steps every couple, three years, but what if the shopping center expands and adds an anchor? Does your rent go up? It does typically, but a lot of owners gloss over it. What if that expansion is at the other end? And what if it’s an Auto Zone, auto store that they add on the property and your rent’s supposed to go by eight or 10%? How does that help you? There’s so many of those little wrinkles in there. I think there’s tenant responsibilities that go way before what to expect in the lease, but there are tenant responsibilities that a tenant should adhere to. Inspect the space, measure the space. Landlords don’t always have the perfect measurement. And what if you’re paying for fifteen extra square feet, for the seven years there. Look at utilities, mechanical. Typically in a grocery anchored shopping center, the HVAC unit is the responsibility of the tenant to maintain. Well, what if they’re giving you a ten year old unit? You just signed a 10 year lease, those things don’t last that long. There’s a lot that goes into all of those things.

[00:19:42] Karl: I know we can’t cover all the different topics, but I do know that types of leases come up. Ground leases, and triple net, and so on. One of the more common is a triple net lease, can you explain that to someone that may be being introduced into the typical type of lease they might see in a typical retail?

[00:20:02] Mario: You typically see that in a standalone property. A Walgreens, a Wendy’s type. And the tenant pays for everything on that property. That’s typically how it’s structured. And that as opposed to the landlord doing common area work and a number of other things, it’s a tenant’s responsibility and many landlords love that.

[00:20:25] Karl: For which one? Which type of lease is the tenant?

[00:20:27] Mario: Stand, what I would call your standalone leases. Your Walgreens stores, your Wendy’s locations, your fast food locations that are just standing there on their own parcel. They don’t own it. Those companies don’t want to own their real estate because it ties up a lot of their capital, but they are willing to lease it, and operate it, and go from there. And landlords love it, because it’s cashflow positive, in many respects.

[00:20:53] Rico: A lot of businesses around here in the city of Peachtree Corners, for example, especially with the new Town Center, those parcels are individually leased like you’re saying. And some of them can be sold, you know, and then you’d have a new landlord. What happens then?

[00:21:06] Mario: Right. Well, the landlord typically has to honor the lease. There’s no doubt about it. It goes like Karl was talking about at one point earlier in terms of, just as if a tenant is going to sell their business and assign it. They’ll work with the landlord and vice versa. If the landlord sells a to another landlord.

[00:21:22] Karl: What are some of the, you mentioned about the HVAC and just things that people are sometimes surprised on. Who’s typically responsible for like the HVAC unit for a particular space?

[00:21:34] Mario: It’s so interesting that I would think of this like death by a thousand cuts. A tenant can know the rent and they look at that statement and they go, look, my rent is 3,500 a month or 2,500 a month. It’s the other things that happen. You have a plumbing issue that is within the four walls. Anything within the four walls typically, it belongs to the tenant. So the HVAC unit, which is attached. Typically it’s in grocery anchored or open air centers, not the Avalon’s of the world generally. But these, they own their HVAC unit, a landlord installs it for the first tenant and then the landlord will make sure it runs for the first tenant. And after that they wipe their hands and they say, tenant you maintain it. Tenant, you take care of it. And if the second generation tenant in there gets a twelve-year-old unit in three years into their lease, that’s on the tenant to replace a five or ten ton unit that costs five to $10,000 or more in that way. Plumbing issues within the space, the hot water heater blows up, there’s electrical issue within the space. And it’s all within the four walls. That’s the tenant’s as well. So in some respects, you’re leasing the area, but it’s like a homeowner who has to take care of all of the niggling little things there.

[00:22:51] Rico: So any negotiation then has to happen before that lease signing. You know that the unit is 12 years old, you want to negotiate your responsibility out of it or a new one before you move in, I imagine. And even the electrical may have been, if it’s a 15 year old establishment, you may have new things coming in that’s going to draw a lot more electricity. So wouldn’t you negotiate that stuff ahead of time. Can you negotiate that? How easy is that, even?

[00:23:17] Mario: Well, you can ask for the moon Rico. I think that a tenant can ask the landlord for money to remodel. And the landlord may give it to you if it’s a use they need. And the landlord will say, okay, here’s twenty-five thousand dollars. You, tenant, have to put the money into the space. You have to give me a release of lien, meaning it’s paid for. And then I will give you back the $25,000. And this is where a lot of tenants fail, guys. They just don’t know to do this type of in-depth inspection on HVAC, on electrical, on the demand. Now the city will help to some degree because they have to get a building permit. They have to submit their plans and so forth, but there are horror stories related to, does the tenant fog a mirror and have a pulse? Okay, sign the lease. And next thing you know, the tenant’s saying, I didn’t know I had to have a permit. I was just going to knock down two walls.

[00:24:12] Rico: Yeah. And you don’t get to that stage until after you signed a lease.

[00:24:15] Mario: Absolutely right.

[00:24:17] Rico: You mentioned something before, I want to ask about also, just one quick thing on CAM. CAM is marketing dollars, that a?

[00:24:24] Mario: No, no, no. Common area maintenance.

[00:24:27] Rico: Okay.

[00:24:27] Mario: And in these shopping centers, again let’s do grocery anchored or the Forum or Town Center. The landlord will pay for all the exterior maintenance and the building envelope maintenance. So if they’re painting the outside, if they’re resurfacing the asphalt, electricity for lights in the common area, landscaping, snow removal, security. All of that is the landlord fronting the money and charging the tenant. And very quickly, the way it works is the landlord says, I need a million dollars to run this property. That comes out to $10, a square foot or $5 a square foot, depending on the size of the property. And they will bill $5 per year to that tenant. A thousand square foot tenant, $5,000 a year, we’ll call it 400 a month. And at the end of the year, if it costs them 1,000,001, they bill that a hundred thousand dollars back to the tenants to settle up. It’s basically a settlement. So, common area maintenance.

[00:25:27] Rico: So that was my other question. I know one of the retail places at one of these larger outdoor facilities was always complaining that every once in a while that CAM, that fee, was way more than was expected. And there was no cap you had to pay it. And that was the end of that. I mean, is that normal? That’s almost like a question mark. It could be anywhere.

[00:25:51] Mario: Well, I’m going to answer that three different ways. One, national tenants with leverage typically will negotiate a cap of an increase per year. 2%, 3% increase is all you can give me. So if you had a terrible snow year or electricity goes through the roof or their security needs better coverage, or you add shifts, okay. The local tenants don’t have that kind of leverage and they lack some sophistication and representation in that area, so they don’t negotiate a cap. At the same time, Rico, is the sky the limit? Not really. Because the landlord has to stay competitive against the competition. So if you’ve got even some regional players or you’ve got a lot of local people in your center, they start comparing notes. We all know what the houses in our neighborhood sell for, guys. And these tenants will start to do the same thing in terms of, I got a thousand dollar settlement bill, I got a $1,200 one. And the landlord has to make sure they’re managing that relationship. And they’re fiscally responsible because they’re competing down the street with the shopping center that’s anchored by the next best grocery store. So that’s the deal.

[00:27:04] Karl: I’m curious along on that a little bit more. There’s often time, and I’ve heard of a situation where a landlord notified a tenant that they had to do a major piece of construction on the space, for code reasons. They found something, but in effect it would take several months, more than a month to fix, and they would have to close down the business while this is being done. Now to lose an entire month or two of revenue while doing this. And to our understanding in the lease, the tenant would still be responsible for paying the lease rate while that was happening, just based on the base language of the lease. I think the point you’re making about reading your lease and understanding what you’re signing up to is a really important one. And leases could be 30, 40 pages with lots of terms and conditions that you may not be aware of. So having someone fluent in leases, both legally and commercially is really important to really understand where are the areas you can push on with the landlord or things that can help mitigate risk. And where are the things that you probably don’t have a good chance of renegotiating or taking out a lease. I’m wondering what are some of the practices you do for your clients to work with to help identify those risks better?

[00:28:29] Mario: On the front end?

[00:28:31] Karl: On the front end, before the lease is signed.

[00:28:33] Mario: Well, the first thing you said, and I had a note here or two that said in case of, let’s talk about a similar case. If you lease in a shopping center and there is a strong grocery anchored center and it’s 80% leased and then that grocery store closes to remodel for a year, that isn’t unusual. I went through that when I was in another company in Florida. They closed down a Publix store for one year. And what does that do to all of those tenants? Be it a florist or the pizza guy or the Asian restaurant. That you can try and anticipate as a small business tenant, a shoe repair business, whatever, and say, well, I’m willing to pay this rent. I’m willing to stay in this space, but if XYZ, fill in the blank. If the anchor closes and you can name it, or you can say the number of square foot close, if occupancy drops beneath 50%, then this is what these national tenants negotiate all the time. They’re able to say I’m going to 50% of my rent, and if it’s not fixed within 12 months, I can cancel my lease. So all of those options are open. It’s simply a matter again of sophistication, representation, and sticktoitiveness on the part of the tenant. In terms of why I said, don’t fall in love with any location. Now, if you happen to be in one of those spaces and you happen to find yourself in this situation, landlords want occupancy guys. It drives me a little crazy to read on that next door website, people saying that, oh, they raised the rent so high that, you know, the landlord’s rent, the landlord’s rent. That’s easily an assumption, but the truth is the landlord wants the occupancy. The landlord’s lender wants them to keep the occupancy. So any tenant should be able to approach a landlord and say, what can you do for me? You’re going to shut me down for a month. And I can’t afford the rent for that month. I can’t afford the loss of revenue. Can I just tack it onto the end? Can you increase my lease an extra month at the end of my lease? Can you spread that over the next 12 months? There’s a number of ways that you can deal with that type of situation. And lastly, there’s business interruption insurance too. And I think that that might qualify if the landlord has a code issue, and so forth. And the landlord’s not going to do the nice thing, right? And say, well, if you dig far enough in the lease. So again, it goes back to representation and knowledge.

[00:31:08] Karl: Let’s talk a little bit about some of the terms in the lease that could have a lot of impact on a business. The personal guarantee security at the beginning. Why do landlords ask for the personal guarantees and how is it that some tenants are able to negotiate that out of their lease?

[00:31:27] Mario: Every landlord is going to ask for that because, they’re asking for it if the business should fail, they don’t want to go after an empty shell of a company, an LLC or whatever you’ve incorporated as. There’s no assets there. It’s just shell. They want to be able to go after, and this is sad, but literally the personal belongings of a tenant. And I’ve worked for landlords that have done that. And they said, oh, you own a house. Oh, you have a 401k. And so any tenant worth their salt should not sign a personal guarantee. Or if they do sign it, they should sign it for the first year until they establish themselves with that landlord. And then it drops off. To kind of jump ahead, in an assignment situation, there’s language and leases that allow you to assign the lease and the landlord can’t reasonably withhold approval. But they also require the original lease holder to guarantee the lease for the balance of the term and so forth. And all those are negotiable. It’s just, they’re buried and difficult to understand in that way. So landlords want a guaranteed revenue stream and they want recourse in case the tenant fails. And I will tell you the churn rate of local businesses, and you guys know it really well, is very high in these grocery anchored centers. Restaurants, you know, have a very short shelf life, that aren’t well capitalized or have made a decision that didn’t work out in the market or just things in the market went sideways.

[00:33:02] Karl: So we talk about the next lease. Someone’s coming with a lease renewal coming up. Any advice for those folks on things that they want to look at? They’ve signed the first one, maybe they didn’t, you know, they weren’t as wise as they are now. What are some things that they should be looking for when they’re signing a new lease at the same location?

[00:33:23] Mario: I would hope a tenant would have kept a laundry list of concerns. That they would say, you know, there’s things that I’m concerned about. I’m getting, I think Rico mentioned that I’m getting this big bill. Is there a cap on my CAM? Am I always going to be hit with 3% increases when inflation isn’t quite 3% for that? What additional services am I getting? Are utilities going up? So that, they ought to look at. Putting a cap on CAM or some type of idea that they know what they’re going to anticipate. Every business wants to know what their expenses are going to be going forward to the best of their knowledge or that they can get. Karl, you and I spoke sometime ago about records, records, records, finances, finances, finances. You have to have your finances in order. Because when that renewal comes up, you really have to understand what your occupancy costs are. And occupancy costs are your rent and charges as a percentage of your total sales. That will help you understand in the anticipation of a renewal that you know you’re going to get additional rent costs. And you can, hopefully in that time have made relationships and network with people to begin to understand some of the more clauses, the difficult clauses in the lease on assignment and related to that. Here’s a simple one, you’ve been in the property five years. Your business is stable. Not great, but you’re making a living. And you realize there’s a new pylon sign out there. Negotiate a spot on the pylon sign. There’s never enough slots, but at renewal time is a perfect time to say landlord put me up there. I’ll pay for the little sign that says, you know, Mario shoe repair. And that will help visibility. And the landlord because again, they want occupancy. If you’ve performed well, all of that will go a long way. Another piece at renewal time, you can ask for dollars to remodel. Even if it’s 10 grand, a coat of paint, new light fixtures. Those are the kinds of things that a landlord will certainly help you with. But I would always have a plan B. Look for another location that may be suitable for you. That maybe you started looking 12 months before. I’m sorry if I go on and on, but all of this is coincidental to the fact that I’ve had two conversations with two long-term automotive repair shops in the market, just coincidentally. In one case the owners are getting older and I think, and I think we’re going to sell it. but we’re going to get a new landlord and we’re not sure what to do and so forth. And so I’ve kind of told them, I’d be glad to help them just look at the lease and see what it is they’re going to get. And the other case, not more than a week later, one guy has been in the space 30 years and they’re going to sell his parcel that he doesn’t own. He’s a tenant and he’s not sure where he’s going to go. And he’s just starting to look and they’re going to rezone it for apartments. And here, this guy has put his heart and soul into 30 years in the business. He didn’t own the garage, but he’s looking to move. And I offered, said, look, I, you know, I’m not a broker or anything like that, but I’m glad to just talk with you and walk you through some of these very points we’re talking about where you’re going and when.

[00:36:35] Karl: I think you’re hitting on something that, on a final point that I wanted to make clear to folks. In each of those scenarios, I see something common. And I don’t want to criticize, to call it a lack of planning, but every business owner should have two types of plans in their business. No matter how small, informal. I would call, what would be an annual plan. What do you think is going to happen this year? Expenses and revenues. And are you going to hire more people and so on. And that’s going to tell you what’s happening over about a six month to one year period of planning. And you should put it down on paper and you should hold yourself accountable to what that plan is. And if you don’t, if you’re not good at creating one, get someone to help you do it. It’ll help you create a north star direction for your business. But on the second plan should be a little bit longer range. Three to five year plan. And your comment around, rent versus own. Very often I’ll run into a business owner that’s looking to exit or retire, and they’ve been approached by the landlord several times to acquire the property. And they made the decision for whatever reason, good decision or bad decision, not to do it. But in the scenario that plays out when the owner sells it, now they have to deal with the move. This is a bigger problem that it creates a new location that they have to solve. So time horizon matters because if they know they may be retiring in the next three to five years, what they negotiate in a lease, could be very different than if they plan on being there for 30 years. So having that conversation upfront about, where do you see yourself three to five years? What are some of your goals for the business? Is really important before you sign your next lease. In another case with a business owner we chatted, they were thinking of retirement and we talked through various scenarios. And one of the scenarios was winding down the business and closing the doors. Not selling it, not trying to. And in that case, you don’t sign a new lease. You plan an exit that’s aligned with the timeline of your lease and you slowly, you ramp down the business. So at the end of the lease, you walk away, there are no obligations. The important thing is, is kind of coming up with that plan so you can do the right lease. What’s unfortunate is someone signs a five-year lease, they’re ready to retire in one year. And now they’ve got four years to wonder about, what to do with the lease that they just signed. So that planning discussion is something that’s really, really important.

[00:39:12] Mario: No doubt. I wish I would meet some of those folks and that’s one of the areas I’d like to help folks concentrate on going forward.

[00:39:21] Rico: Yeah, interesting that this conversation is a small piece of any business, right? But it affects the business so widely. Exit plans or even just getting into it, the commitment that you have to make and not understanding maybe where some of the hidden costs are. I’ve learned a lot just from this past 45 minutes with you Mario. Things that I didn’t realize, and some stuff that as we’re talking about it, I’m beginning to realize more. It could be a make or break thing now.

[00:39:49] Karl: It is super critical. And if you talk to anybody in my line of work, the landlord and the lease is always an important point of inspection when we first talk to business owners. Along with, what are you trying to do? And then each one may guide a very different set of decisions or things to work on, to set their business up for success in the future. Mario, I’d love to share, do you have a way of folks can contact you if they wanted to chat with you and learn more about what you do and how you help people? What’s the best way to reach you?

[00:40:23] Mario: Sure. I think my email address as I start to get the CLR real estate management wheels turning a little bit. My personal email address, would work really well. It’s Mario.Mireles4@gmail.com.

[00:40:39] Karl: Excellent. And just so you know, Mario is a neighbor here in Peachtree Corners. He lives here, been living here for years in Peachtree Corners. And is one of the many talented, knowledgeable resources in our community that helps business owners and folks in the community navigate some of those challenges that they may run into. We definitely should have another discussion. On leases and real estate in the future, because there’s so many more layers we could talk about around that. But I want to thank you for spending some time today and sharing some of your knowledge and experience and wisdom for folks that are considering leasing a new space for their business, growing and picking out a new space. Or if they’re looking at renegotiating a new lease, I think we’ve given them some things to think about it and options to explore. So thank you so much for that

[00:41:27] Mario: You’re welcome. I’ve very much enjoyed it guys.

[00:41:29] Karl: I would like to take Mario Mireles of the principal at CLR Real Estate Management for joining us today. And just again, the insight that you shared is something that folks need to understand better when they’re signing those 35, 40, 50, page leases and ask some more questions, understand what they’re signing. But most importantly, don’t be afraid of it. Look at how many businesses have been successful navigating leases. It is not something to be afraid of, just like your supply chain or dealing with your customers, or dealing with your employees. Lease is just another aspect of the business that once you understand the risk that’s involved, the things that impact your expenses, understanding your occupancy costs and having it related to your revenue. And be able to compare for your type of business, what are the industry norms for that? So that you always are in line with that. Are there things that you can do to be successful? So don’t be afraid of them, just get people like Mario and others to help you look through leases and negotiate the best term that works for both you as a tenant and the landlord. So thank you again, Mario. Well, and I’m Karl Barham with Transworld Business Advisors of Atlanta Peachtree. Our business advisors are available to consult with businesses. Whether it’s working through leases and understanding where there might be challenges in connecting you with resources that could help you be successful in that area. Or when you’re ready to retire and figuring out, what do I need to do now to retire and exit the business or in the next three to five years. Our team of consultants help with valuations. We do business assessments where we look at the qualitative and quantitative aspects of a business to help identify the things that you can work on to be successful when you’re ready to sell and, or acquire a new business. Rico, why don’t you tell us a little bit about what you’ve got going on?

[00:43:24] Rico: Sure. Peachtree Corners Magazine is, we’re working on the next issue right now. So if you’re a business looking to reach out to this community of the city of Peachtree Corners, think about either advertising, in Peachtree Corners Magazine. We hit 19,000 plus homes in their mailboxes. We’re a nice big publication and it’s not crowded with ads on purpose. Our ad ratio to editorial is, small and that gives us a lot of space to be able to tell the stories in the city. And we’ll never run out of things to talk about. That next issue is the Faces in Peachtree Corners. So there’s going to be stories about 20 different people here in the community that have impacted our city or their family, or the community that they’re in. So visit LivingInPeachtreeCorners.com to find out a little bit more about that. If you want to become a sponsor of these podcasts, certainly reach out to me. And if you’re looking to do online content, social media and video production, just let me know. You can reach me at Rico@MightyRockets.com and I’ll be more than happy to speak to you about that.

[00:44:26] Karl: Yeah, well, thank you Rico for all that you do for the community as well. Both from the magazine, digital content, sharing the story. And again, I do recommend folks checking out and exploring it and from time to time, there’s a solicitation out there for a story and then ideas and contributors. Always looking for folks and new stories. So please reach out through the website to Rico, to share some of the great stories that are happening here in Peachtree Corners and surrounding areas. So thank you for that. We’ll have another podcast for you coming in the near future. We continue to find local talent in the community and folks that can help the small business owners in particular be successful here in the area. So thank you for following the Capitalist Sage Podcast. You’ll find us on various streaming platforms, iTunes, iHeartRadio, Spotify, YouTube and Facebook, of course as well. So, just continue and also on the website. Follow us on any of your favorite platforms and check out our library of episodes. We’re well over 60, we’re approaching 75 episodes in there. So we’re continuing to serve the community in this way. And thank you for all your support.

[00:45:38] Rico: Thank you guys.

Related

Business

The Forum Gives Sneak Peek of New Eateries and Community Spaces

Published

2 days agoon

July 24, 2024

If you’ve been to or near the Forum in the past few months, you’ve probably noticed cranes and construction crews. The anticipation of the first phase of renovation of the 22-year-old retail center has left a lot of Peachtree Corners residents as well as nearby patrons excited to see changes.

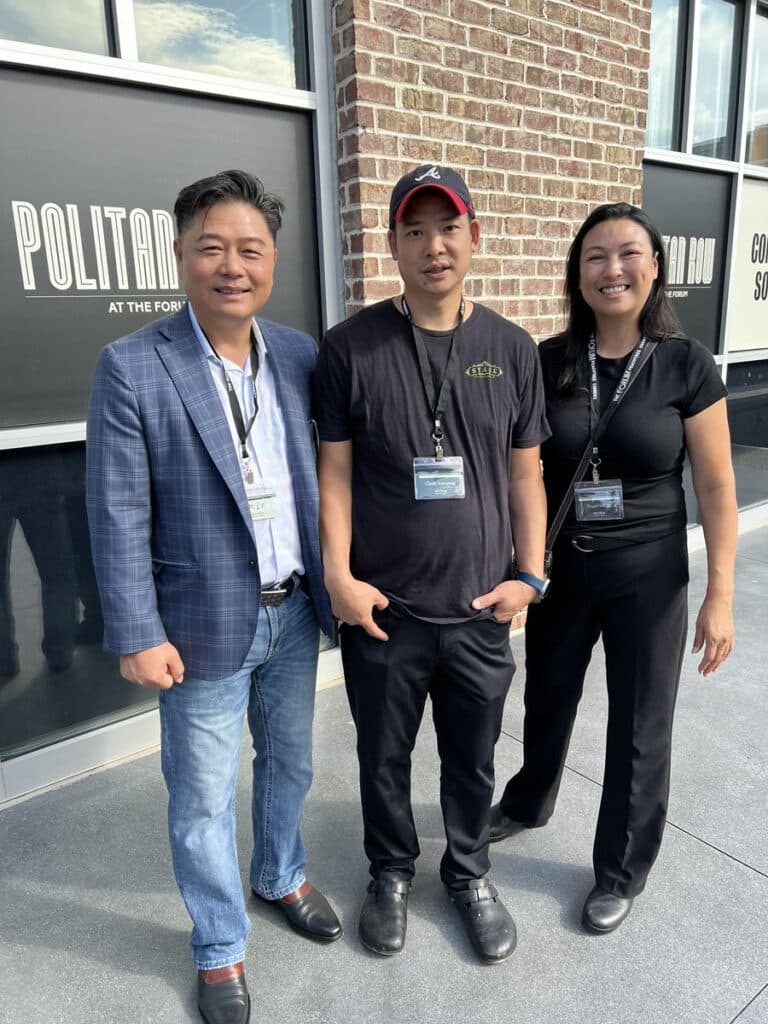

The Forum administration invited the media for a hard hat tour on July 17. The event showcased the redevelopment progress ahead of The Plaza’s grand opening on Aug. 8.

Scrumptious bites incoming

Executives from the development and leasing teams joined on-site management and led attendees around the new central gathering space, guest amenities and Politan Row, the newly created 10,000-square-foot food hall.

Dining concepts from veterans at Sheesh, Twenty-Six Thai and newbie Gekko Kitchen were the first food vendors announced for the space, which is expected to open in January.

“We can’t wait to introduce the Peachtree Corners community to our food hall experience,” said Politan Group CEO Will Donaldson in a news release. “Every detail from the design to the bar program to the cuisine is thoughtfully curated to inspire guests to not only mingle with one another but to connect with our incredible restaurateurs and discover new favorites.”

During the tour, Donaldson explained that eventually there will be seven different global cuisines in the Politan Row food court at the Forum featuring well-known and up-and-coming local talent. Once complete there will be a central bar, a private event venue and a covered outdoor patio.

“One of the things that we’re excited about is this unique design that we’ve come up with, that’s very specific to this area,” he said. “We’ll be open seven days a week for lunch and dinner. Whether you’re with a group for lunch or with your family, it works great for multiple settings.”

Twenty-six Thai owner Niki Pattharakositkul said the restaurant will work with local vendors to source the freshest meats and produce possible.

“There are certain types of produce and protein we try to source locally, but sauces and the more exotic produce and herbs, we have to import from Thailand,” she said. “Our brand is trying to move towards doing things locally and sustainably.”

Working with organizations such as Georgia Grown limits the use of large food distribution companies. Since starting Twenty-six Thai in 2016, Pattharakositkul has launched seven locations across metro Atlanta, including at Politan Row’s Ashford Lane and Colony Square.

The eatery describes itself as an “authentic wok-fired Southeast Asia-inspired menu featuring items such as pad Thai, pad see ewe and classic drunken noodles.”

Sheesh, a Mediterranean concept that uses simple, wholesome ingredients prepared with unique spices and blends, is run by corporate executive chef Charlie Sunyapong and director of operations Raquel Stalcup. The two are also members of the group behind full-service restaurants Stäge at Town Center and Pêche at the Forum.

The popularity of those suburban concepts has already taken off. With Sheesh, they’re looking to do something different.

“There are going to be some things that are unique to Sheesh that you’re not going to get at the other places,” said Sunyapong. “You’re not getting a whole restaurant; this is quicker fare.”

Gekko Kitchen, a former food truck transformed into a hibachi and ramen experience, will be serving fresh, fast bowls that are more colorful and lighter than traditional hibachi fare.

Gathering spots

Development Manager Nick Lombardo explained that NAP is moving away from building big construction projects from scratch like Colony Square in Midtown Atlanta and Avalon in Alpharetta.

“As a company, North American Properties pivoted around 2020 from building big ground-up construction to more redevelopment with already existing properties,” he said. “With the thought of great assets that just need a little more attention Infused into them to create value, we bought the Forum in 2022.”

He said that value-add propositions done at The Forum will create a more walkable center.

“Trying to compete with the internet on convenience is a very tough task, so the way we differentiate is by experiences,” he said. “We host between 150 to 200 events every year. We have things like concerts, wellness and fitness events and we have child playtime events. Our marketing team does a great job and they’re the differentiator when it comes to what makes our property stand out.”

By the first week of August, a large gathering space will be unveiled in the central area of the property between Pottery Barn and seafood restaurant Pêche. It will have a nine-foot LED screen capable of hosting movie nights and sports viewing. There will also be musical performances featuring local artists.

“We’re not in competition with Town Center,” said Charlotte Hinton, marketing manager at The Forum. “Town Center has gates like a real music festival and we’re more like a ‘chill and enjoy the music’ vibe where you can grab a beer and hang out or maybe kind of walk around.”

The smaller space and artificial turf are unlike the Town Center space where attendees spread blankets and bring chairs. The Forum will have furniture and seating in the space so folks can just gather and either enjoy time with family or partake in events.

The Forum will also offer valet parking on a limited schedule at that end of the property.

More improvements

Although the construction equipment will have moved out, the jewel box building will house a yet-to-be-named restaurant that will open early next year.

“We’re pretty much done with what we’re doing as far as landlord work,” said Lombardo. “We ask our tenants to bring their brand and their design and their material pallet and put that on the building to express their brand identity. They know their brand better than we do. They know how to best design their building and how it functions and works.”

It’s the same process with retail stores, he added.

“We always ask all of our new tenants to come in here when they’re building their storefront,” he said. “They’re not just selling their clothes; they’re selling a lifestyle in the brand so we ask them to push their brand out to the street.”

Even with the new spaces, there will be no shortage of parking, Lombardo added. “There’s plenty of parking behind these buildings,” he said pointing toward Pêche. “What we’ve done is enhance the connectivity to those areas. We’ve redone this breezeway and we’re adding lighting and connecting the parking lot to the main boulevard here. The goal is to replace cars with people and activity and bring a sense of community to the property.”

Related

Business

Taste of Peachtree Corners: PCBA Showcases Local Restaurants

Published

1 week agoon

July 17, 2024

The Taste of Peachtree Corners has been in the works for years, but the COVID-19 pandemic put many key events on hold for the Peachtree Corners Business Association (PCBA).

But luckily this year, the dedicated staff of volunteers successfully executed a memorable event and introduced a lot of local business owners to their neighboring restaurants and caterers.

As I walked up to the Community Chest Room at Peachtree Corners City Hall on June 27, there was a line outside the door. I later found out that over 100 people had registered to attend the event. I got checked in quickly and was faced with a “passport” of 10 Peachtree Corners restaurants serving everything from high-end bakery items to good old-fashioned barbecue, and modern twists on seafood and American cuisines.

Let’s talk about the food

The idea was to visit all 10 restaurants and collect stars while trying samples and small plates. My first stop was Firebirds Wood Fired Grill, and they had my favorite – homemade chips and queso. The queso was smoky and mildly spicy with a great depth of flavor. What a great start. Next up was Chopt. Creative Salad Co. I had never heard of this restaurant before, but they blew me away with a perfect amuse-bouche of cherry tomato, pesto, mozzarella, and olive oil. These guys understand simple and fresh Mediterranean flavors.

The folks from Marlow’s Tavern were also on-site serving shrimp and grits with jalapeno, spinach and tomato beurre blanc. This is definitely the style of elevated food I’ve come to expect from Marlow’s. And as a nice touch, they prepared a refreshing blueberry cocktail.

Another familiar face was set up on the other side of the room. J.R.’s Log House Restaurant served southern favorites like pulled pork sliders, baked beans and mac n’ cheese. I couldn’t pass this one up. The pulled pork was tender, tangy and saucy. Exactly what I want from a barbecue. Lazy Dog’s table really impressed me with its presentation. The tuna cup with rice, avocado and chili with chips on the side, was a real stunner.

Moe’s Southwest Grill was also on-site handing out tasty tequila lime chicken with rice, avocado, and black beans. This super hearty and comforting entrée was followed by a seafood course from PECHE Modern Coastal. Crab cakes with a croissant pinwheel, roasted garlic and lemon aioli and arugula were on the menu and the flavor combinations were simply fantastic.

PECHE’s sister restaurant STAGE Kitchen & Bar was next door offering a tuna and salmon tostada with avocado, eel sauce, spicy mayo, and cilantro. This was easily one of my favorite bites of the night. The tostada was crunchy and light with clean and bright flavors. No kidding, I could probably eat this every day for lunch.

I moved on the Smoke’s Family Catering and owner Phillip Smoke had whipped up enough barbecue to feed an army. I had the pleasure of trying the smoked chicken with potato salad and it was the perfect pairing. Last but not least: dessert. I capped off the evening with a beautiful chocolate ganache-filled croissant with perfect lamination and flaky texture.

The inspiration behind the event

With a (very) full stomach, I caught up with PCBA President Lisa Proctor to talk about the event.

“We knew that COVID was really hard on a lot of our restaurants to get people back in,” said Proctor. “We wanted to do it in June because we wanted to celebrate our military. Everybody remembers them maybe on Memorial Day or different things, but June is the 80th anniversary of D-Day.”

“The military is always close to our heart,” she added. “We’re also very proud of our restaurants. They all have gone above and beyond.”

Tonight, the PCBA was honoring the Armed Forces and its brave veterans while bestowing two donation checks to very worthy causes.

The first check for $500 went to Folds of Honor. Since 2007, Folds of Honor has provided life-changing scholarships to the spouses and children of America’s fallen or disabled military. And now, their mission expands to the families of America’s first responders.

The second check for $500 was given to Light Up the Corners, a 501(c)(3) volunteer organization with an annual glowing, flashing, blinking, shining, nighttime running party and fundraiser in one. All proceeds from the event go to benefit less fortunate children and families in the Peachtree Corners community who are struggling by giving them the chance to participate in life-enhancing programs and activities at the Fowler YMCA.

Over the past 12 years, the PCBA has awarded 19 scholarships and donated more than $156,000+ back to the Peachtree Corners community.

Related

Business

Local Resident Opens AtWork Location in Peachtree Corners

Published

2 weeks agoon

July 10, 2024

AtWork, one of nation’s leading staffing franchises, has opened its third Metro Atlanta location in Peachtree Corners, Georgia at 6185 Buford Highway, Suite E-100.

AtWork Peachtree Corners is locally-owned by Kamal Bhatia, an immigrant from India with decades of experience in hospitality and as the Senior Vice President of Operations of Atlanta-based Action Bartending School.

“There is an incredible need for AtWork’s services in Peachtree Corners,” said Bhatia. “Since migrating here in 1996, I’ve witnessed Atlanta evolve and sprout new communities north of the city, including my own. Peachtree Corners has become a hub for thriving businesses, and my goal with this location is to be a key resource between companies and job seekers to support the continued growth of our local economy.”

Bhatia’s son and daughter will assist him in the business.

“This is an opportunity to create a legacy company to ensure our community is supported for generations to come,” he said.

For more than three decades, AtWork’s mission has been to connect people with jobs and jobs with people. With more than 100 locations nationwide, AtWork puts nearly 40,000 individuals to work each year in administrative, light-industrial, accounting and finance, hospitality, IT and management-level positions at some of the nation’s largest and most recognizable companies.

“We’re proud to open our doors in Peachtree Corners and provide a common place for both job seekers and growing businesses to turn for staffing solutions,” said Jason Leverant, President and COO of AtWork.

“AtWork will serve as a key resource to help employees thrive, businesses prosper and communities flourish. Kamal is the perfect partner to champion our mission and be a servant leader in her local community,” he added.

Related

Read the Digital Edition

Subscribe

Keep Up With Peachtree Corners News

Join our mailing list to receive the latest news and updates from our team.

You have Successfully Subscribed!

What’s going on at Jones Bridge Park and the Challenges of Urban Development

Taste of Peachtree Corners: PCBA Showcases Local Restaurants

The Forum Gives Sneak Peek of New Eateries and Community Spaces

Southwest Gwinnett Mayors Share Visions for the Future

8 Events Happening In and Around Peachtree Corners This August

Peachtree Corners Shines Bright with Light Up the Corners Glow Race this August

Peachtree Corners Shines Bright with Light Up the Corners Glow Race this August

The Forum Gives Sneak Peek of New Eateries and Community Spaces

8 Events Happening In and Around Peachtree Corners This August

Southwest Gwinnett Mayors Share Visions for the Future

Taste of Peachtree Corners: PCBA Showcases Local Restaurants

What’s going on at Jones Bridge Park and the Challenges of Urban Development

Local Resident Opens AtWork Location in Peachtree Corners

CHRIS 180 Expands its Services into Gwinnett County [Podcast]

Light up the Corners [Video]

Capitalist Sage: Business Leadership in Your Community [Podcast]

Cliff Bramble: A Culinary Adventure through Italy

Top 10 Brunch Places in Gwinnett County

A Hunger for Hospitality

THE CORNERS EPISODE 3 – BLAXICAN PART 1

Top 10 Indoor Things To Do This Winter

The ED Hour: What it takes to Remove Barriers from Education

Peachtree Corners Life

Topics and Categories

Trending

-

Business1 week ago

Taste of Peachtree Corners: PCBA Showcases Local Restaurants

-

Business2 days ago

The Forum Gives Sneak Peek of New Eateries and Community Spaces

-

City Government4 days ago

Southwest Gwinnett Mayors Share Visions for the Future

-

Around Atlanta4 days ago

8 Events Happening In and Around Peachtree Corners This August