Business

Major Shipping Company Expands in Peachtree Corners

Published

6 years agoon

One of the largest shipping companies in the world is expanding its operation in Peachtree Corners. Hapag-Lloyd, which merged with United Arab Shipping Company (UASC) in May 2017, is consolidating operations at its offices located at 5515 Spalding Drive.

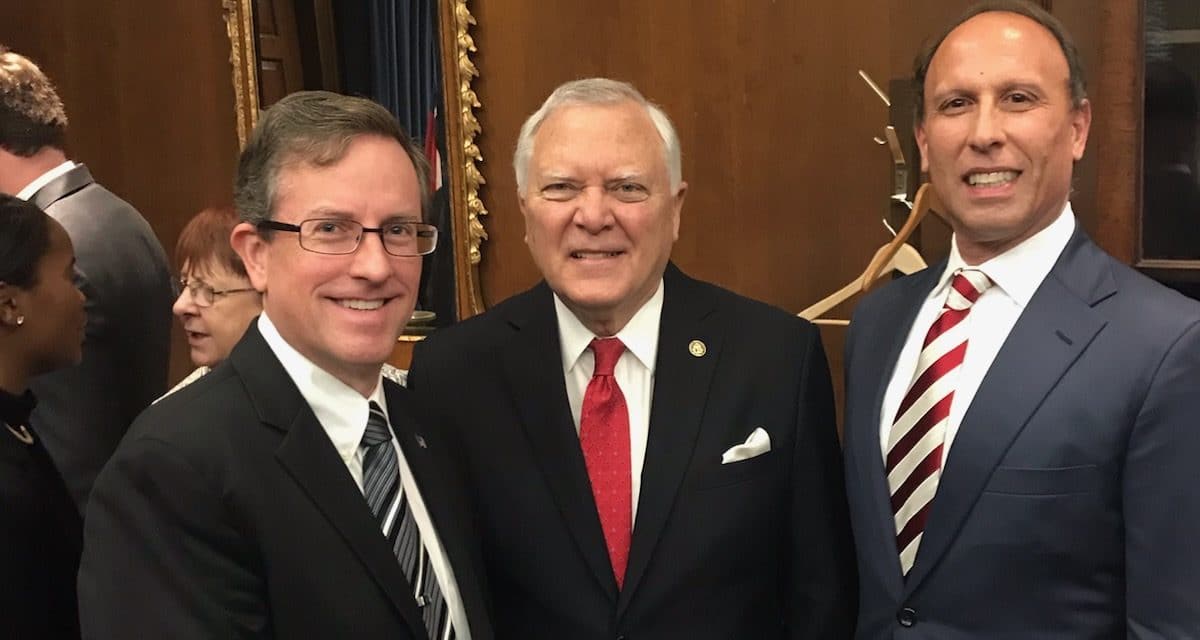

The company plans to invest $5.5 million over the next two years and create 363 new jobs, in addition to the 178 jobs that will remain at the North American headquarters and training facility in Peachtree Corners. Hapag-Lloyd made the expansion announcement on the steps of the state Capitol on Dec. 18.

“We welcome the company’s growth and expansion,” said Mayor Mike Mason. “Hapag-Lloyd is a significant employer in the city with global name recognition. They are making an investment in their facility, creating jobs, and contributing to the economic viability of Peachtree Corners.”

Hapag-Lloyd is one of the leading operators in the Transatlantic, Middle East, Latin America and Intra-America trades. With 230 vessels and more than 12,000 employees, Hapag-Lloyd is the fifth-largest shipping company in the world, serving customers in 127 countries.

“Keeping what you have is good for the community and future development,” said Economic Development Manager Jennifer Howard. “When we surveyed the business community, they said they wanted the city to focus on retention and expansion. Existing businesses are at the heart of strong, local economies.”

The city worked in collaboration with the Georgia Department of Economic Development and Partnership Gwinnett in supporting the expansion. Partnership Gwinnett is a public-private initiative dedicated to bringing new jobs and capital investment to Gwinnett County.

Related

Business

The Forum Gives Sneak Peek of New Eateries and Community Spaces

Published

2 days agoon

July 24, 2024

If you’ve been to or near the Forum in the past few months, you’ve probably noticed cranes and construction crews. The anticipation of the first phase of renovation of the 22-year-old retail center has left a lot of Peachtree Corners residents as well as nearby patrons excited to see changes.

The Forum administration invited the media for a hard hat tour on July 17. The event showcased the redevelopment progress ahead of The Plaza’s grand opening on Aug. 8.

Scrumptious bites incoming

Executives from the development and leasing teams joined on-site management and led attendees around the new central gathering space, guest amenities and Politan Row, the newly created 10,000-square-foot food hall.

Dining concepts from veterans at Sheesh, Twenty-Six Thai and newbie Gekko Kitchen were the first food vendors announced for the space, which is expected to open in January.

“We can’t wait to introduce the Peachtree Corners community to our food hall experience,” said Politan Group CEO Will Donaldson in a news release. “Every detail from the design to the bar program to the cuisine is thoughtfully curated to inspire guests to not only mingle with one another but to connect with our incredible restaurateurs and discover new favorites.”

During the tour, Donaldson explained that eventually there will be seven different global cuisines in the Politan Row food court at the Forum featuring well-known and up-and-coming local talent. Once complete there will be a central bar, a private event venue and a covered outdoor patio.

“One of the things that we’re excited about is this unique design that we’ve come up with, that’s very specific to this area,” he said. “We’ll be open seven days a week for lunch and dinner. Whether you’re with a group for lunch or with your family, it works great for multiple settings.”

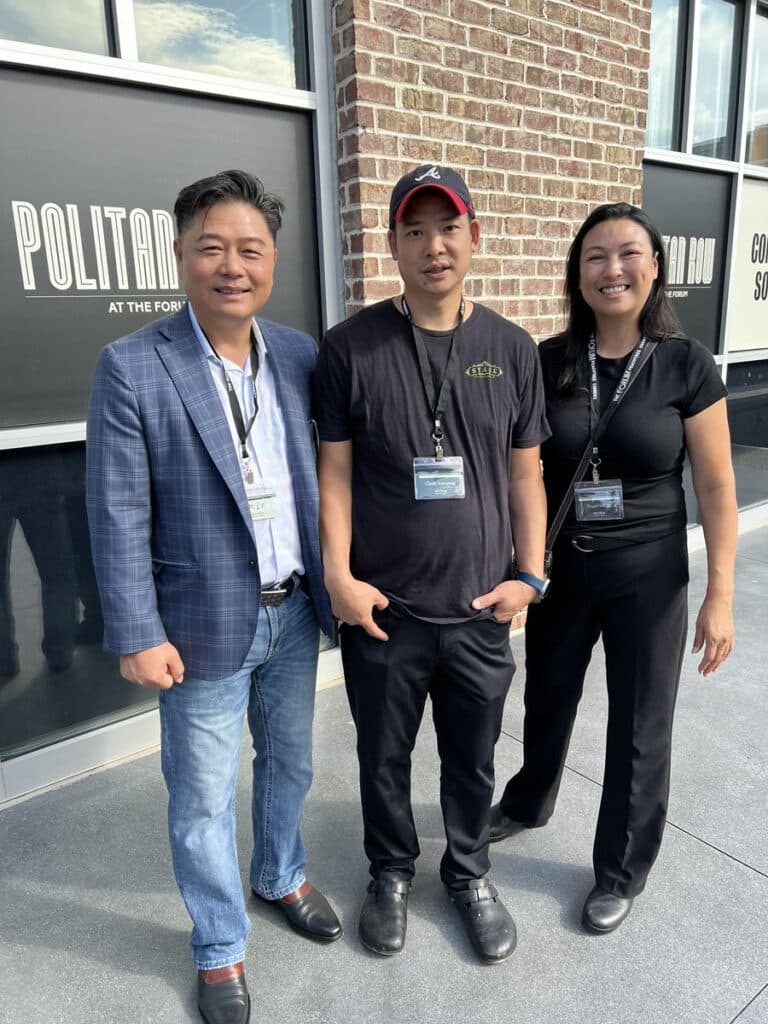

Twenty-six Thai owner Niki Pattharakositkul said the restaurant will work with local vendors to source the freshest meats and produce possible.

“There are certain types of produce and protein we try to source locally, but sauces and the more exotic produce and herbs, we have to import from Thailand,” she said. “Our brand is trying to move towards doing things locally and sustainably.”

Working with organizations such as Georgia Grown limits the use of large food distribution companies. Since starting Twenty-six Thai in 2016, Pattharakositkul has launched seven locations across metro Atlanta, including at Politan Row’s Ashford Lane and Colony Square.

The eatery describes itself as an “authentic wok-fired Southeast Asia-inspired menu featuring items such as pad Thai, pad see ewe and classic drunken noodles.”

Sheesh, a Mediterranean concept that uses simple, wholesome ingredients prepared with unique spices and blends, is run by corporate executive chef Charlie Sunyapong and director of operations Raquel Stalcup. The two are also members of the group behind full-service restaurants Stäge at Town Center and Pêche at the Forum.

The popularity of those suburban concepts has already taken off. With Sheesh, they’re looking to do something different.

“There are going to be some things that are unique to Sheesh that you’re not going to get at the other places,” said Sunyapong. “You’re not getting a whole restaurant; this is quicker fare.”

Gekko Kitchen, a former food truck transformed into a hibachi and ramen experience, will be serving fresh, fast bowls that are more colorful and lighter than traditional hibachi fare.

Gathering spots

Development Manager Nick Lombardo explained that NAP is moving away from building big construction projects from scratch like Colony Square in Midtown Atlanta and Avalon in Alpharetta.

“As a company, North American Properties pivoted around 2020 from building big ground-up construction to more redevelopment with already existing properties,” he said. “With the thought of great assets that just need a little more attention Infused into them to create value, we bought the Forum in 2022.”

He said that value-add propositions done at The Forum will create a more walkable center.

“Trying to compete with the internet on convenience is a very tough task, so the way we differentiate is by experiences,” he said. “We host between 150 to 200 events every year. We have things like concerts, wellness and fitness events and we have child playtime events. Our marketing team does a great job and they’re the differentiator when it comes to what makes our property stand out.”

By the first week of August, a large gathering space will be unveiled in the central area of the property between Pottery Barn and seafood restaurant Pêche. It will have a nine-foot LED screen capable of hosting movie nights and sports viewing. There will also be musical performances featuring local artists.

“We’re not in competition with Town Center,” said Charlotte Hinton, marketing manager at The Forum. “Town Center has gates like a real music festival and we’re more like a ‘chill and enjoy the music’ vibe where you can grab a beer and hang out or maybe kind of walk around.”

The smaller space and artificial turf are unlike the Town Center space where attendees spread blankets and bring chairs. The Forum will have furniture and seating in the space so folks can just gather and either enjoy time with family or partake in events.

The Forum will also offer valet parking on a limited schedule at that end of the property.

More improvements

Although the construction equipment will have moved out, the jewel box building will house a yet-to-be-named restaurant that will open early next year.

“We’re pretty much done with what we’re doing as far as landlord work,” said Lombardo. “We ask our tenants to bring their brand and their design and their material pallet and put that on the building to express their brand identity. They know their brand better than we do. They know how to best design their building and how it functions and works.”

It’s the same process with retail stores, he added.

“We always ask all of our new tenants to come in here when they’re building their storefront,” he said. “They’re not just selling their clothes; they’re selling a lifestyle in the brand so we ask them to push their brand out to the street.”

Even with the new spaces, there will be no shortage of parking, Lombardo added. “There’s plenty of parking behind these buildings,” he said pointing toward Pêche. “What we’ve done is enhance the connectivity to those areas. We’ve redone this breezeway and we’re adding lighting and connecting the parking lot to the main boulevard here. The goal is to replace cars with people and activity and bring a sense of community to the property.”

Related

Business

Taste of Peachtree Corners: PCBA Showcases Local Restaurants

Published

1 week agoon

July 17, 2024

The Taste of Peachtree Corners has been in the works for years, but the COVID-19 pandemic put many key events on hold for the Peachtree Corners Business Association (PCBA).

But luckily this year, the dedicated staff of volunteers successfully executed a memorable event and introduced a lot of local business owners to their neighboring restaurants and caterers.

As I walked up to the Community Chest Room at Peachtree Corners City Hall on June 27, there was a line outside the door. I later found out that over 100 people had registered to attend the event. I got checked in quickly and was faced with a “passport” of 10 Peachtree Corners restaurants serving everything from high-end bakery items to good old-fashioned barbecue, and modern twists on seafood and American cuisines.

Let’s talk about the food

The idea was to visit all 10 restaurants and collect stars while trying samples and small plates. My first stop was Firebirds Wood Fired Grill, and they had my favorite – homemade chips and queso. The queso was smoky and mildly spicy with a great depth of flavor. What a great start. Next up was Chopt. Creative Salad Co. I had never heard of this restaurant before, but they blew me away with a perfect amuse-bouche of cherry tomato, pesto, mozzarella, and olive oil. These guys understand simple and fresh Mediterranean flavors.

The folks from Marlow’s Tavern were also on-site serving shrimp and grits with jalapeno, spinach and tomato beurre blanc. This is definitely the style of elevated food I’ve come to expect from Marlow’s. And as a nice touch, they prepared a refreshing blueberry cocktail.

Another familiar face was set up on the other side of the room. J.R.’s Log House Restaurant served southern favorites like pulled pork sliders, baked beans and mac n’ cheese. I couldn’t pass this one up. The pulled pork was tender, tangy and saucy. Exactly what I want from a barbecue. Lazy Dog’s table really impressed me with its presentation. The tuna cup with rice, avocado and chili with chips on the side, was a real stunner.

Moe’s Southwest Grill was also on-site handing out tasty tequila lime chicken with rice, avocado, and black beans. This super hearty and comforting entrée was followed by a seafood course from PECHE Modern Coastal. Crab cakes with a croissant pinwheel, roasted garlic and lemon aioli and arugula were on the menu and the flavor combinations were simply fantastic.

PECHE’s sister restaurant STAGE Kitchen & Bar was next door offering a tuna and salmon tostada with avocado, eel sauce, spicy mayo, and cilantro. This was easily one of my favorite bites of the night. The tostada was crunchy and light with clean and bright flavors. No kidding, I could probably eat this every day for lunch.

I moved on the Smoke’s Family Catering and owner Phillip Smoke had whipped up enough barbecue to feed an army. I had the pleasure of trying the smoked chicken with potato salad and it was the perfect pairing. Last but not least: dessert. I capped off the evening with a beautiful chocolate ganache-filled croissant with perfect lamination and flaky texture.

The inspiration behind the event

With a (very) full stomach, I caught up with PCBA President Lisa Proctor to talk about the event.

“We knew that COVID was really hard on a lot of our restaurants to get people back in,” said Proctor. “We wanted to do it in June because we wanted to celebrate our military. Everybody remembers them maybe on Memorial Day or different things, but June is the 80th anniversary of D-Day.”

“The military is always close to our heart,” she added. “We’re also very proud of our restaurants. They all have gone above and beyond.”

Tonight, the PCBA was honoring the Armed Forces and its brave veterans while bestowing two donation checks to very worthy causes.

The first check for $500 went to Folds of Honor. Since 2007, Folds of Honor has provided life-changing scholarships to the spouses and children of America’s fallen or disabled military. And now, their mission expands to the families of America’s first responders.

The second check for $500 was given to Light Up the Corners, a 501(c)(3) volunteer organization with an annual glowing, flashing, blinking, shining, nighttime running party and fundraiser in one. All proceeds from the event go to benefit less fortunate children and families in the Peachtree Corners community who are struggling by giving them the chance to participate in life-enhancing programs and activities at the Fowler YMCA.

Over the past 12 years, the PCBA has awarded 19 scholarships and donated more than $156,000+ back to the Peachtree Corners community.

Related

Business

Local Resident Opens AtWork Location in Peachtree Corners

Published

2 weeks agoon

July 10, 2024

AtWork, one of nation’s leading staffing franchises, has opened its third Metro Atlanta location in Peachtree Corners, Georgia at 6185 Buford Highway, Suite E-100.

AtWork Peachtree Corners is locally-owned by Kamal Bhatia, an immigrant from India with decades of experience in hospitality and as the Senior Vice President of Operations of Atlanta-based Action Bartending School.

“There is an incredible need for AtWork’s services in Peachtree Corners,” said Bhatia. “Since migrating here in 1996, I’ve witnessed Atlanta evolve and sprout new communities north of the city, including my own. Peachtree Corners has become a hub for thriving businesses, and my goal with this location is to be a key resource between companies and job seekers to support the continued growth of our local economy.”

Bhatia’s son and daughter will assist him in the business.

“This is an opportunity to create a legacy company to ensure our community is supported for generations to come,” he said.

For more than three decades, AtWork’s mission has been to connect people with jobs and jobs with people. With more than 100 locations nationwide, AtWork puts nearly 40,000 individuals to work each year in administrative, light-industrial, accounting and finance, hospitality, IT and management-level positions at some of the nation’s largest and most recognizable companies.

“We’re proud to open our doors in Peachtree Corners and provide a common place for both job seekers and growing businesses to turn for staffing solutions,” said Jason Leverant, President and COO of AtWork.

“AtWork will serve as a key resource to help employees thrive, businesses prosper and communities flourish. Kamal is the perfect partner to champion our mission and be a servant leader in her local community,” he added.

Related

Read the Digital Edition

Subscribe

Keep Up With Peachtree Corners News

Join our mailing list to receive the latest news and updates from our team.

You have Successfully Subscribed!

What’s going on at Jones Bridge Park and the Challenges of Urban Development

Taste of Peachtree Corners: PCBA Showcases Local Restaurants

The Forum Gives Sneak Peek of New Eateries and Community Spaces

Southwest Gwinnett Mayors Share Visions for the Future

8 Events Happening In and Around Peachtree Corners This August

Peachtree Corners Shines Bright with Light Up the Corners Glow Race this August

Peachtree Corners Shines Bright with Light Up the Corners Glow Race this August

The Forum Gives Sneak Peek of New Eateries and Community Spaces

8 Events Happening In and Around Peachtree Corners This August

Southwest Gwinnett Mayors Share Visions for the Future

Taste of Peachtree Corners: PCBA Showcases Local Restaurants

What’s going on at Jones Bridge Park and the Challenges of Urban Development

Local Resident Opens AtWork Location in Peachtree Corners

CHRIS 180 Expands its Services into Gwinnett County [Podcast]

Light up the Corners [Video]

Capitalist Sage: Business Leadership in Your Community [Podcast]

Cliff Bramble: A Culinary Adventure through Italy

Top 10 Brunch Places in Gwinnett County

A Hunger for Hospitality

THE CORNERS EPISODE 3 – BLAXICAN PART 1

Top 10 Indoor Things To Do This Winter

The ED Hour: What it takes to Remove Barriers from Education

Peachtree Corners Life

Topics and Categories

Trending

-

Business1 week ago

Taste of Peachtree Corners: PCBA Showcases Local Restaurants

-

Business2 days ago

The Forum Gives Sneak Peek of New Eateries and Community Spaces

-

City Government4 days ago

Southwest Gwinnett Mayors Share Visions for the Future

-

Around Atlanta4 days ago

8 Events Happening In and Around Peachtree Corners This August