City Government

Peachtree Corners Orders Certain Businesses to Close Temporarily

Published

5 years agoon

In an emergency-called meeting at 3 p.m. today, the Peachtree Corners Mayor and City Council voted unanimously to pass an Emergency Ordinance calling for certain actions deemed necessary or appropriate for the public health and safety of its residents.

The ordinance to temporarily close certain establishments where the public gathers and where social distancing recommendations cannot be maintained will help slow the spread of the highly contagious coronavirus and is in place for the protection and safety of all who live and work in the city.

The restrictions outlined below are in keeping with the Order issued on March 25, 2020, from Gwinnett County. All cities in Gwinnett County plan to adopt these restrictions.

This Ordinance will be enforced by the Gwinnett County Police Department and the City’s Code Enforcement Department.

The Emergency Ordinance declares that:

- All gyms, fitness centers, fitness studios, theaters, live performance venues, bowling alleys, arcades and other similar establishments within Peachtree Corners be temporarily closed.

- Restaurants, brewpubs, breweries, and other eating establishments in Peachtree Corners are to cease offering dine-in and/or outdoor/patio service. Such eating establishments may continue to prepare and offer food to customers through delivery, takeout, and/or drive-thru service.

- Cafeterias or on-site dining services in hospitals, nursing homes, assisted living facilities and other similar facilities within city limits following previously issued state and federal public health guidelines are not subject to closure requirements of this Order.

- If a business is licensed by the City to sell alcohol for on-premises consumption, such business, during the efficacy of this Ordinance only, shall be authorized to sell unopened bottles, or otherwise appropriately sealed containers, of alcohol for take-away for consumption off-premises. Any alcohol licensee who engages in a course of conduct permitted under this section does so at the licensee’s own peril as it concerns the licensee’s state liquor license. This ordinance makes no representation as to the legality, under state law and state alcohol licenses, of any course of conduct undertaken pursuant to this section.

- All employers and businesses which remain open for use by the public must take the necessary steps to restrict in-person contact and maintain a distance of six (6) feet between individuals while in the establishment.

- The Governor’s Executive Order No. 03.23.20.01 is hereby incorporated by reference herein, such that:

- a. All persons ordered by the Department of Public Health to isolate, quarantine, or shelter in place within their homes or place of residence shall comply with such executive order or administrative order. In accordance with the Governor’s executive, the following populations are specifically included:

- i. Those persons who live in a nursing home or long-term care facility;

- ii. Those persons who have chronic lung disease;

- iii. Those persons who are currently undergoing cancer treatment; and

- iv. Those persons included in any Department of Public Health Administrative Order.

- b. All businesses which possess a license to operate as or otherwise meet the definition of “bar” as defined in Official Code of Georgia Section 3-1-2(2.1) shall cease operation.

- c. No business, establishment, corporation, non-profit, corporation, or organization shall allow more than ten (10) persons to be gathered at a single location if such gathering requires persons to stand or to be seated within six (6) feet of any other person.

- a. All persons ordered by the Department of Public Health to isolate, quarantine, or shelter in place within their homes or place of residence shall comply with such executive order or administrative order. In accordance with the Governor’s executive, the following populations are specifically included:

The restrictions contained within this Ordinance became effective upon adoption and shall expire concurrent with the expiration of the emergency ordinance of March 21.

At 7pm tonight, Wednesday, March 25 we’ll be live streaming with City Manager Brian Johnson and talking about this and other issues. We’ll post the audio/video here once it’s complete or visit our Facebook page and like it for notification of the stream https://facebook.com/peachtreecornerslife

Related

City Government

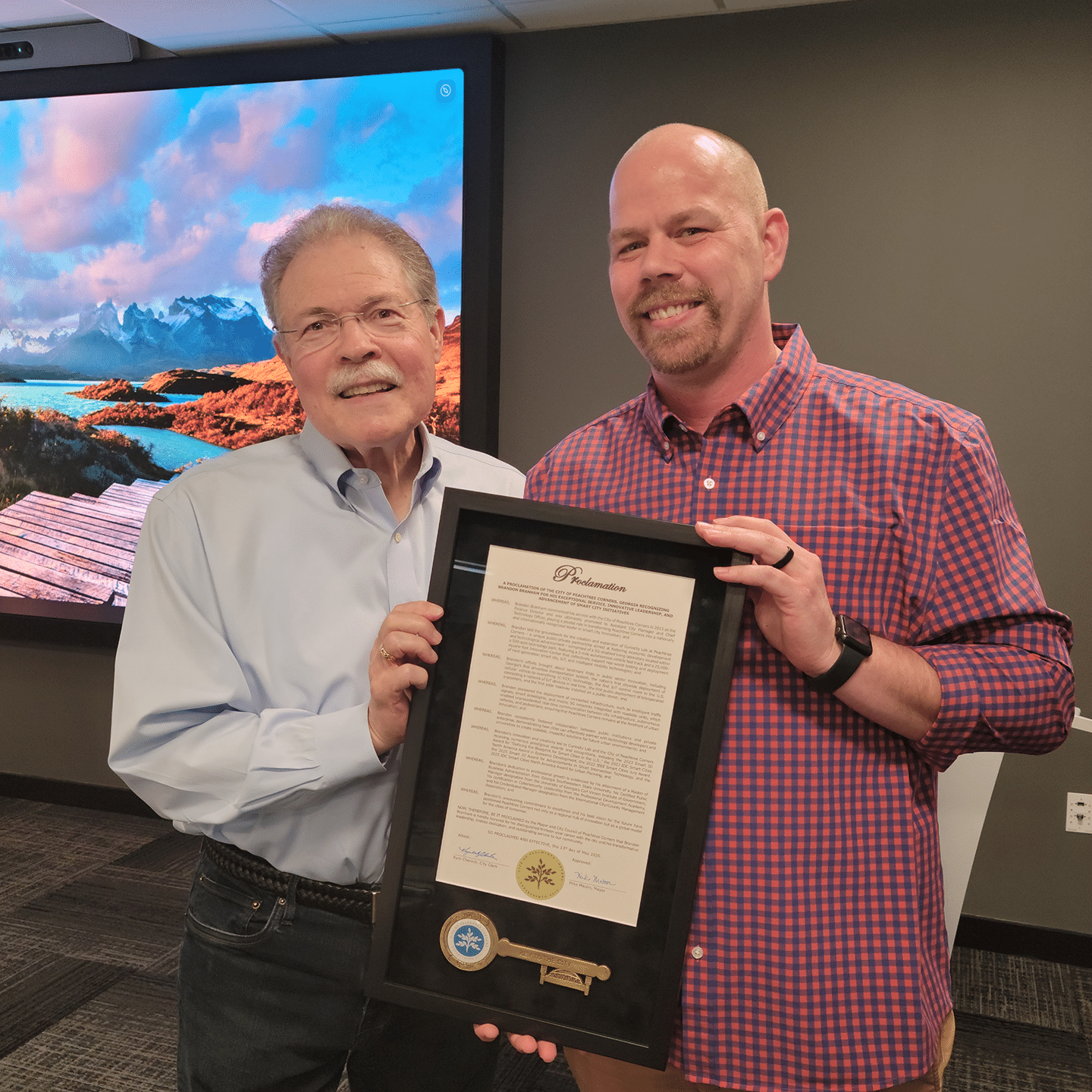

Brandon Branham Honored for Transformative Leadership in Peachtree Corners

Published

2 days agoon

May 20, 2025

The City of Peachtree Corners recently honored Assistant City Manager Brandon Branham with an official proclamation for his years of leadership and service to the city.

Branham began his tenure in 2013 as finance director and was later promoted to assistant city manager and chief technology officer. In each of those roles, he’s played an instrumental part in guiding Peachtree Corners’ transformation from a suburban community into an internationally recognized hub of technology and innovation.

A decade of accomplishments

Among his many accomplishments, Branham spearheaded the development of the Curiosity Lab at Peachtree Corners, a 5G-enabled living laboratory and innovation center located within a 500-acre technology park.

Under his leadership, the city also achieved numerous national firsts in public sector technology, including the launch of Georgia’s first driverless shuttle system, the country’s first citywide C-V2X (cellular vehicle-to-everything) deployment and the first solar roadway installed on a public street.

“Brandon’s vision and commitment to innovation have positioned Peachtree Corners at the forefront of smart city development not just in Georgia, but across the nation,” said City Manager Brian Johnson. “His leadership has shaped the future of our city, and we are deeply grateful for his service.”

Partnerships and collaborations

Throughout his twelve-year career with the city, Branham emphasized collaboration between the public and private sectors, creating partnerships with tech companies and academic institutions to pilot scalable, real-world solutions.

His efforts have garnered numerous accolades for Peachtree Corners, including multiple Smart Cities awards and recognition for urban planning and intelligent mobility technologies.

New opportunities

Now, as Branham prepares to leave his role and move on to new opportunities, the City of Peachtree Corners “extends its heartfelt appreciation and best wishes for his continued success.”

“Brandon has left a lasting legacy,” Johnson said. “We look forward to seeing the impact he’ll continue to make in the smart city space and beyond.”

Related

City Government

Peachtree Corners Hosts Discussion About the Future of Local Policing

Published

1 week agoon

May 12, 2025

Although crime isn’t on the rise, and the Gwinnett County Police Department (GCPD) is fulfilling its role in fighting crime, the City of Peachtree Corners is asking residents, business owners and city stakeholders if they believe the city should form its own police department.

With over 100 people in attendance, City Manager Brian Johnson led the discussion about the future of policing in Peachtree Corners. He presented the findings from a survey conducted by the Center for Public Safety Management (CPSM), a nationally-recognized law enforcement consulting and training firm, as well as information about patrol officer staffing, response times, costs to tax payers and a potential timeline.

Ensuring public safety

Johnson kicked off his presentation by explaining that it is the duty of the mayor and city council to ensure public safety, including reviewing law enforcement.

“Maybe it needs to grow, maybe it needs to change its focus. But city council is the one that has the decision-making responsibility,” he said.

He was also adamant that this isn’t a done deal.

“I hit this point already, but I want to hit it again. This is the start of a conversation, a community conversation and feedback to council. There hasn’t been a decision,” he said. “Council has not received this presentation from me. They’re here to watch and learn from your feedback of this.”

Mayor Mike Mason was present at the meeting, along with all of the city council members except Eric Christ who was out of town and watching remotely.

Issues and obstacles

Johnson explained that the grounds for the inquiry were based on issues about communication, access to information and enforcement of city-specific ordinances. He cited an example where a city rule that private residences can’t be rented on a short-term basis like Vrbo or Airbnb wasn’t enforced by GCPD. An owner tried to circumvent the ordinance by only renting the outside of the house. A loud pool party ensued, and frustrated neighbors dialed 911.

“Officers showed up and they said, ‘We can’t enforce the city’s noise ordinance,’” Johnson said.

The first stage to fix this problem was creating the marshal program to bridge the gap between code enforcement and GCPD.

“[We thought] they would be able to enforce both local ordinance and state law, since they are a function of the city, and they could maybe be a force multiplier for Gwinnett since [marshals] don’t have to respond to 911 calls,” said Johnson.

But other issues arose shortly after the department was formed.

“We were still working towards getting that good balance, but we have been faced recently with a couple of things that make it harder for us,” said Johnson.

Seeking shared access

Instead of GCPD giving PTC marshals read-only, quick access to incident reports, dispatch calls and other information, the marshals department was required to file open records requests through the same process as any civilian.

“They were denied, as well as the city of Sugar Hill, [when] asked for the ability to see, not change, but see the computer-aided dispatch information, so that they would know where Gwinnett County police officers were; so that they could avoid stepping on their toes or maybe looking to support their efforts, and they haven’t been granted that,” said Johnson.

He added that the GCPD has video cameras on certain roadways that are used for various reasons, and law enforcement can use them when there’s crime in the area. Peachtree Corners marshals were denied access to those cameras.

“Conversely, we have a couple hundred cameras in the city, and we definitely want them to have access to them,” said Johnson. “So the frustration out of not being able to get that symbiosis between the marshals and police made us start thinking, all right, you know, is there another option?”

Community feedback

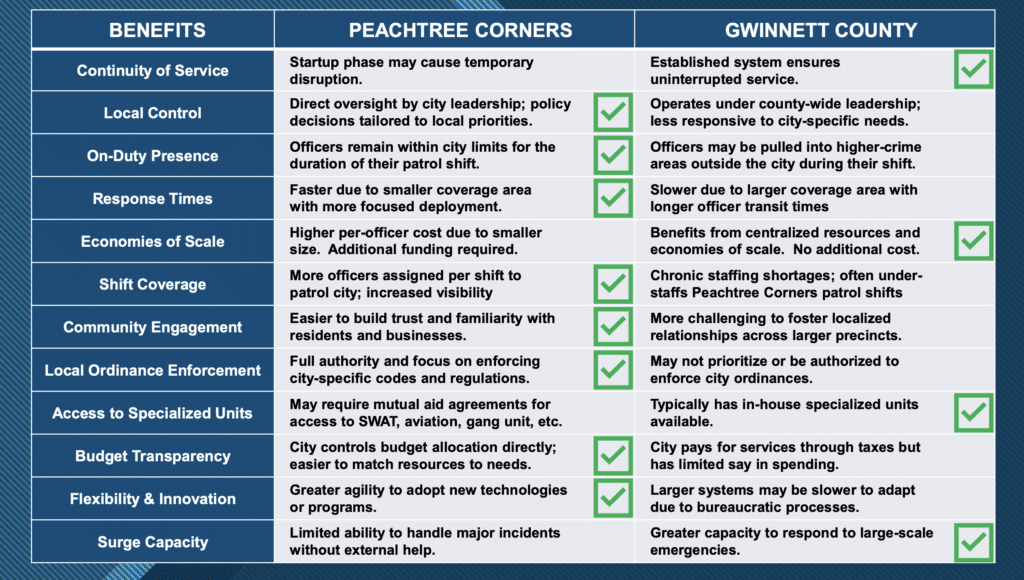

CPSM utilized data from GCPD to discern if Peachtree Corners could feasibly stand its own force. It also took into consideration crime trends, costs and many other factors. It recommended a 55-officer department, costing $12.1 million annually, with a $2.2 million upfront cost.

Comparing the two options to “renting vs. owning” the primary law enforcement agency in the city, Johnson presented pros and cons for each. Once the question-and-answer portion began, there was no obvious choice. Men and women, young and more advanced in age, had both similar and differing opinions.

One young man, who identified himself as a local small business owner named Alexander, argued that with artificial intelligence increasing the efficiency of administrative tasks, perhaps the city wouldn’t need a full 68-man department of civilians and sworn officers.

Some accused the city of devising a solution in need of a problem. Others were concerned that paying approximately $100,00 for a study was throwing good money after bad.

But at the end of it all, the city is continuing to seek feedback and is encouraging everyone to make informed decisions. The meeting was taped and is available on the city website along with Johnson’s PowerPoint presentation, a copy of the study done by CPSM and a survey.

As far as a timeline goes, city officials would like folks to take the summer to mull it over and come back in the fall to take another look at the proposal.

Related

City Government

City of Peachtree Corners Awarded Certificate of Achievement From GFOA for Seventh Straight Year

Published

2 weeks agoon

May 9, 2025

The City of Peachtree Corners’ finance department has been awarded a Certificate of Achievement for Excellence in Financial Reporting from the Government Finance Officers Association of the United States and Canada (GFOA) for its 2024 financial year-end comprehensive annual financial report (CAFR).

The GFOA’s Certificate of Achievement is the highest form of recognition in governmental accounting and financial reporting, and its attainment represents a significant accomplishment by a government and its management.

It is the city’s seventh year of receiving the award and represents a significant accomplishment by the city’s finance department and its leadership.

According to a GFOA release, “The report has been judged by an impartial panel to meet the high standards of the program, which includes demonstrating a constructive ‘spirit of full disclosure’ to clearly communicate its financial story and motivate potential users and user groups to read the report.”

“We are pleased to again receive this honor,” said City Manager Brian Johnson. “Our finance department, and Finance Director Cory Salley, are to be commended for this achievement, as it is the highest form of recognition GOFA presents.”

A comprehensive annual report

The city’s finance department produces the CAFR each year and works with independent auditors to verify the city’s financial situation and standing.

“This prestigious award affirms Peachtree Corners’ dedication to exceeding basic requirements by producing comprehensive annual financial reports that reflect a strong commitment to transparency and full disclosure,” said Assistant City Manager Brandon Branham.

About the GFOA

The Government Finance Officers Association (GFOA), founded in 1906, represents public finance officials throughout the United States and Canada.

The association’s more than 20,000 members are federal, state/provincial and local finance officials deeply involved in planning, financing and implementing thousands of governmental operations in each of their jurisdictions. GFOA’s mission is to advance excellence in public finance.

To learn more about the GFOA, visit gfoa.org.

For more about the City of Peachtree Corners, visit peachtreecornersga.gov.

Related

Read the Digital Edition

Subscribe

Keep Up With Peachtree Corners News

Join our mailing list to receive the latest news and updates from our team.

You have Successfully Subscribed!

Peachtree Corners Hosts Discussion About the Future of Local Policing

D1 Training Brings New Fitness Concept to Peachtree Corners

MomoCon 2025 to bring 60,000 Fans to Atlanta for a Weekend of Cosplay, Animation, Gaming and Music

Atlanta’s Dog Howl-O-Ween Festival Moving to Peachtree Corners for 2025

City of Peachtree Corners Awarded Certificate of Achievement From GFOA for Seventh Straight Year

Local Special Olympics Pickleball Team Honored with State House Resolution

From Boardrooms to the Himalayas: Vandana’s Journey to Purpose and Growing with Intention [Podcast]

Brandon Branham Honored for Transformative Leadership in Peachtree Corners

Music Matters Productions Expands Peachtree Corners Headquarters

Brandon Branham Honored for Transformative Leadership in Peachtree Corners

From Boardrooms to the Himalayas: Vandana’s Journey to Purpose and Growing with Intention [Podcast]

MomoCon 2025 to bring 60,000 Fans to Atlanta for a Weekend of Cosplay, Animation, Gaming and Music

Local Special Olympics Pickleball Team Honored with State House Resolution

Atlanta’s Dog Howl-O-Ween Festival Moving to Peachtree Corners for 2025

D1 Training Brings New Fitness Concept to Peachtree Corners

Peachtree Corners Hosts Discussion About the Future of Local Policing

Light up the Corners [Video]

Capitalist Sage: Business Leadership in Your Community [Podcast]

Cliff Bramble: A Culinary Adventure through Italy

Top 10 Brunch Places in Gwinnett County

A Hunger for Hospitality

THE CORNERS EPISODE 3 – BLAXICAN PART 1

Top 10 Indoor Things To Do This Winter

The ED Hour: What it takes to Remove Barriers from Education

Peachtree Corners Life

Topics and Categories

Trending

-

Business3 days ago

From Boardrooms to the Himalayas: Vandana’s Journey to Purpose and Growing with Intention [Podcast]

-

City Government2 days ago

Brandon Branham Honored for Transformative Leadership in Peachtree Corners

-

Business1 day ago

Music Matters Productions Expands Peachtree Corners Headquarters